In late February, I blogged about the leak of exciting new Chase product, the Chase Freedom Unlimited that allows you to earn 1.5x on everything with no annual fee!

The card was officially announced a few weeks ago at branch locations and is now available for applications online.

The Chase Freedom Unlimited is not amazing if used strictly as a cash back card. The real value lies in the the ability to “combine points” with your Chase Sapphire Preferred (learn more here), allowing the 1.5% cash back “points” to become flexible Ultimate Rewards points that can be further transferred to travel partners such as United, Hyatt, British Airways, Southwest, Singapore, etc.

I value Ultimate Rewards points at ~2 cents each, so using the Chase Freedom Unlimited in conjunction with the Sapphire Preferred is like getting a 3% “return” on everyday spend when transferred to travel partners.

I still love my regular Freedom card too for the 5x rotating quarterly bonus categories, a feature that I consider to be the absolute most valuable component to the no-annual fee card (last year we had the ability to earn 22,500 bonus points at Amazon.com!)

Applying for the Freedom Unlimited

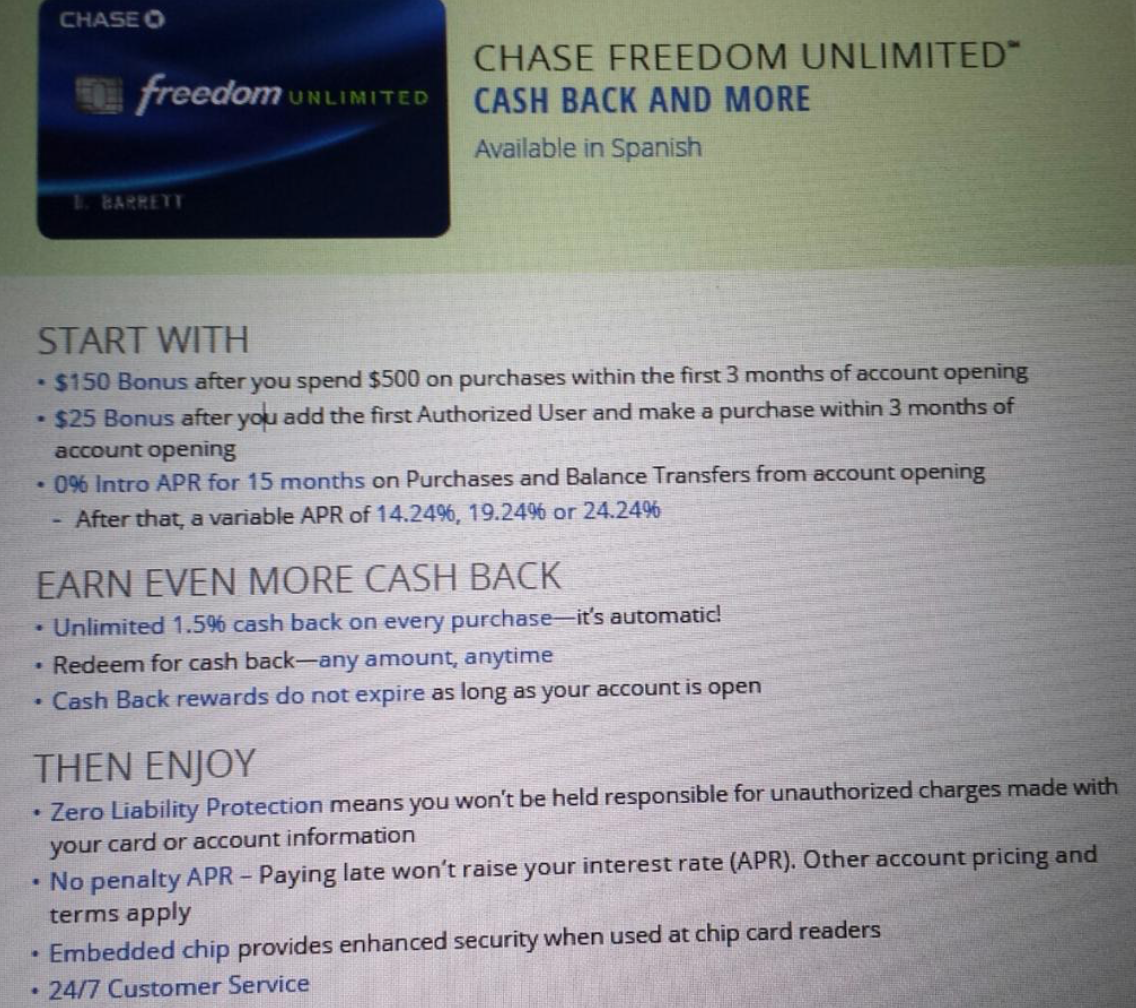

Yesterday night was a quiet evening, so I decided it was an appropriate time to apply for the card. The card comes with $150 (in the form of 15,000 points, which can be transferred into Ultimate Rewards as described above) after you spend $500 on purchases in your first 3 months from account opening.

I was pretty certain I would get a pending review (and I did) because I just recently applied for 3 new cards in February, bringing me to a total of 8 active Chase cards at the time of application.

I decided to call the Chase reconsideration line at 888-245-0625Â to get a decision about my application right away.

I decided to call the Chase reconsideration line at 888-245-0625Â to get a decision about my application right away.

The specialist evaluated my application and told me that I would be approved if I closed out my inactive no-fee United co-branded card. That was a no brainer! The no-fee United card was a downgrade from my United MileagePlus Explorer and it only earned 1/2 a United mile for every dollar spent. Now with the Freedom Unlimited card, I can essentially earn 3x that amount. That was a painless goodbye.

Want the Chase Freedom or Chase Freedom Unlimited Too?

You can view all credit card offers by clicking on the “Recommended Credit Cards†tab on the top navigation bar to view card offers from all banks or view offers via the “Find Your Best Credit Card”  banner on the side of this site.

Anyway, I am calling BS on the Chase 5/24 rule

It’s no secret that times are changing as many of the banks are getting more strict with the amount of credit cards you can get approved for within a 24-month period.

This Chase “5/24 Rule†states that if you’ve opened 5 or more credit card accounts (from any bank) in the past 24 months, it was very unlikely that Chase would approve you for some of their Ultimate Rewards earning cards (such as Freedom, Sapphire Preferred, Ink, etc.).

Now recent reports are saying that this 5/24 rule applies to all Chase products, including co-branded cards (such as the Hyatt Credit Card, United MileagePlus Explorer, etc.).

I can say with 100% certainty that I probably have applied and been approved for at least 15 new credit cards in the past 2 years – including 3 in February alone! I was still able to get approved for the Chase Freedom Unlimited.

What are your thoughts and experiences? Did I simply get lucky or is this 5/24 rule really just a myth?

Seems to me you lucked out and 5/24 is definitely at work. I struck out. Husband too. I have 7 Chase cards. He has 5. We both applied a couple of weeks ago for two Chase cards. I applied for the CFU and he applied for the regular Chase Freedom. We both got denials and the letters we received in the mail stated the same exact reason — (literal quote from the letter): “Too many credit cards opened in the last two years”. We called Recon TWICE. No dice. We both have excellent credit. So you just got lucky, that’s all.

You’re lucky. Wife got declined today due to 4 cards and 3 UAs in the last 24 months. Was told they now look at UAs too. Brutal.

Maybe the underwriter saw your photo and fell in love with you. For us not so good looking people 5/24 applies all the time.

I have three Chase (CSP, Marriott and IHG) and was denied for the 5/24 rule in MARCH! Two were about to drop off my report in May but I just applied for and was approved for two Alaska Airlines cards on Monday. Oh well. Boo me. Although, I would be fine closing my CSP since hubs has one if they asked me to.

Lucky for sure! A month or two ago I was turned down because I had applied for 6 cards in the past 24 months.

You are definitely lucky. I applied for the Chase Ink card in branch in February while opening a new business checking account and was declined (too many cards opened) despite the Chase branch manager pleading my case to the Chase Lending Department. I closed my checking account following the decline. BTW, 800+ credit score and my last four approved cards were from Chase!

you wrote “Now recent reports are saying that this 5/24 rule applies to all Chase products, including co-branded cards (such as the Hyatt Credit Card, United MileagePlus Explorer, etc.)” as though this has been in effect already when this has just been rumored to take effect some time in April. Can you please link to the source which verifies that this is ALREADY in effect for ALL chase products?

I don’t have a source. It’s just blogger reports. If you find one, I’d love to see it too

I think you got lucky. I was one of the first person i knew (and this is a sad thing to brag about) that got slammed with 5/24 last May, when the new rules went into affect for the CSP. No one believed me.

I think that if you hit harder this year, you’d see the 5/24.

It may be chicken little on co brand cards, but something is afoot at Chase and 5/24 is a thing.

I think it depends on your relationship with Chase and how you use your cards. If you never use them past the minimum spend for the signup bonuses and churn frequently, you may be held more strictly to the 5/24 rule. I’ve gotten a couple new Chase cards recently (1 business and 1 personal) with well over 5 new cards in the past two years (more like 15). But I also put a huge amount of both work and personal spend on my Chase cards. They also waive annual fees or provide points to offset them nearly every time I call, citing my heavy use of the cards as to why. I also bank with Chase. If they are making money from their relationship with you, they don’t seem to care as much about the 5/24. Just my experience so far. May be totally wrong and just “lucky” but usually money has a lot more to do with everything in life than luck.

I think you’re onto something here. I was approved, but I’ve paid my bill before it was due, consistently, since opening, and I’ve continued to use the Chase Sapphire as my go-to card. I did have to move my available credit from one card I probably will never use, except for stays in that hotel brand, to the Freedom.

Nope, I have an excellent relationship with them. Over the years, I have had multiple credit cards with Chase for which I have never once been late on a payment and for which I would estimate I have paid in full each month 99 percent of the time. Despite this, and despite a credit score in excess of 830, I was recently turned down for the Sapphire preferred (a card I have not had in 2 1/2 years) due to the 5/24 rule.

I agree with you. My relationship with Chase is excellent… I do business and personal banking with them and I often spend a lot of money on my cards and keep my accounts open.

I took courage from your post. I’m new to the travel/points game. I’ve signed up for at least ten credit cards since January, three of them were Chase products (Sapphire Preferred, Hyatt, and IHG). I had just applied for the Chase Freedom card two days ago, and I got a “decision pending” response. I called the number you provided, and I was able to reduce the credit limit on the IHG card in order to apply it to a credit limit on the Freedom. I was approved. I’m really happy about it, since I’ve decided that I’m going to focus my spending on these two cards, along with my Discover it (since they double my 5X points in the first year).

Thanks for the encouragement. I think the 5/24 rule is a standard for automatic approvals, but in practice, they will make exceptions if they can. I’m very happy with Chase.

As an addition point, I have continued to charge my spending on the Chase Sapphire Preferred, and I have made my payments either before the due date, or immediately upon receiving my statement. I’m a good customer. I think that makes a difference.

You ought to educate yourself before you “call BS” when you don’t know what you’re talking about. There is a reason that Chase denied me for the Freedom Unlimited last week for “too many credit cards in the last two years” and yet approved me today for the Chase Fairmont card. The 5/24 rule exists and currently applies to all Chase-branded personal cards (Freedom, Freedom Unlimited, CSP, Slate). It currently does not apply to business cards or co-branded cards such as IHG, United, etc. I decided to try for the Freedom Unlimited, because Doctor of Credit put in his newsletter that he had seen some reports of people getting the card despite being over 5/24, and it was possible that Chase hadn’t properly applied the rule in their computer systems, but that appears to be incorrect, at least in my case. Doctor of Credit also reported that Chase plans to extend the 5/24 rule to cover business and co-branded cards very soon, but that has not happened yet.

You got lucky. I was turned down recently for a chase credit card due to the 5/24 rule despite fact I consistently am with a FICO score in excess of 830. By contrast, my girlfriend got approved for the Sapphire despite the 5/24 rule and a FICO score only in mid 700s range- the the difference being that she was PREQUALIFIED for the card. Multiple sites indicate that if you are prequalified, the 5/24 rules does not apply. Multiple recent reports have also indicated favorable ability of agents to get cards approved.

Sorry for noob question.

What does BS means?

@Robert: Two things that you did not list are the two I think are most important–SPEND you put on those cards beyond min. required for bonus, and banking with Chase. In my experience, if you are a big customer at the bank (i.e., have accounts there) and you actually USE the cards you have a lot, they are more flexible. As someone said, “money talks.”

I’ll report back after I make my attempt for the new Freedom card, in a couple of weeks. I will be making a very large deposit and also want to put some more spend on my newest card (which is a Chase co-brand card) so I look less like a churner. (In fairness, I call myself a “churner” but I’m not sure I qualify, since I rarely close cards, and have not yet re-applied for a single card I’ve had before. But, I do want THE card for each airline and hotel I frequent and feel cheated if I don’t have/use it. And, I certainly open new accounts primarily for the points.)

Angelina, are you a Chase Private Client customer?

Hi Gary, No I am not. I just do business and personal banking with them.

I applied for 4 cards in March I knew my score would take a hit so I made it worth the while. I applied for a discover, Amex, Macy’s and target. Approved for all of them, I then saw the bonus for chase and thought my chances were slim. I applied and it gave me the 30 day message. I thought I would be denied. I call the application status line and the same message was given ” we will respond with in 30 days” I called the line for the next 2 weeks every other day it seemed. I finally gave up and awaited my letter of denial. On the 3rd week of waiting I logged into my personal chase account and saw an account for my credit card? I had been approved for the chase freedom card! Call the app line again and sure enough it was approved, I received an email later that day that my card was on its way. So the 5/24 rule is up in the air with me.I had applied for 9/24 denied 1 card due to too many inquires. So not sure what they base that rule on.

You are completely right! Thought I didn’t have a chance for the new Freedom Unlimited given my 6 new cards in the past 24 months (Amex SPG just 1 month ago), but after reading your post, I went ahead and gave it a try. No instant approval and called the reconsideration number you provided. Gentleman asked if I would be willing to move credit from another account that I didn’t use (and was planning on closing out anyway) and said for sure! Approved with the new card on its way. Thank you for the encouragement!!

Awesome, I just called that number you listed in the post (I originally applied on Monday). Within the last 2 years, I have applied and received 6 new credit cards (I closed one of them recently). However, 3 of these were Chase (Amazon, Sapphire, Freedom). I do use these cards the most over any other.

I wasn’t automatically approved, but I just needed to call and verify that it was indeed me that submit the credit card application. All I had to do was give them some information and verify my cell phone (they sent a text). Afterwards I was approved on the spot with a pretty good credit limit.

Just wanted to put in my 2 cents to convince someone who hasn’t heard back to call the number and check on the status.

Hello Angelina,

I have a question. My son wants to switch his Sapphire over to a Freedom card. If he is an authorized user on my Sapphire does that allow him to utilize UR or does he need to keep his own card to be able to transfer points and use UR ?

We are working on getting back to the Zilara in Cancun :)

Thanks for all the help,

Beechy

I have another datapoint that’s wildly inconsistent with the 5/24 rule.

I’ve been approved for 11 cards in the past 24 months, 3 of which were Chase cards (and I also had another 3 rejected applications). I just applied for the United Explorer personal card. I got the standard pending response, and called the number that Angelina listed. After some ID verification and no financial questions whatsoever, I was approved. In fact, they gave me a ridiculously large credit limit (double my next highest…).

Moreover, I’m pretty much a classic churner as far as Chase is concerned: I rarely use their cards for much more than the sign up bonus (though I occasionally put some random travel purchases on the Sapphire, but not much at all, and not frequently). In fact, I even churn Chase checking accounts every year for the signup bonus.

I call BS on this fricken article. 5/24 definitely applies. Terrible advice here.

Chase Private Client customer here and got declined due to 5/24. Prequalified for Ink Plus due to Business Platinum checking account and applied in branch with the banker processing application for me. Instant deny after banker called in immediately after application. Senior analyst stated that I opened more than 15 cards in the past 24 months. 24 years old, California, FICO 795, and Chase customer 6 years, business customer for 1 year. Later applied for the Sapphire for the 60,000 point offer, and banker told me not to call in, saying that sometimes people get around 5/24 without calling in. Calling in prompts a senior analyst to manually review and is usually instant deny, at least in my situation. Very disappointed.

Ink Plus was 70k offer and 95 annual fee waived. I think it is only inside the bank.

Yep that was the one I applied for. 70k points and 95 waived 5k/3mth. Mad as hell. Desperately needed UR points for Hyatt Hadahaa and this happens lol. Oh and btw my Chase Sapphire 60k got denied as well. Closed the card back in college (Non CPC Sapphire preferred) in 2014 pretty sure it is already 24 months. Reason was “Already received bonus in the past 24 months” Very mad.

2 dings on my Experian FICO and now my Credit score is down to 783….

Credit is slavery.