Like many points and miles enthusiasts, I have a lot of credit cards. While I am extremely mindful about paying off my accounts in full and on-time each month, sometimes one may slip under the radar from time to time. We’re human and not perfect, right?

Just recently I realized that I missed a payment (oops) on my SimplyCash® Plus Business Credit Card from American Express, and it was a shame because the late payment amount was actually substainally greater than the outstanding balance.

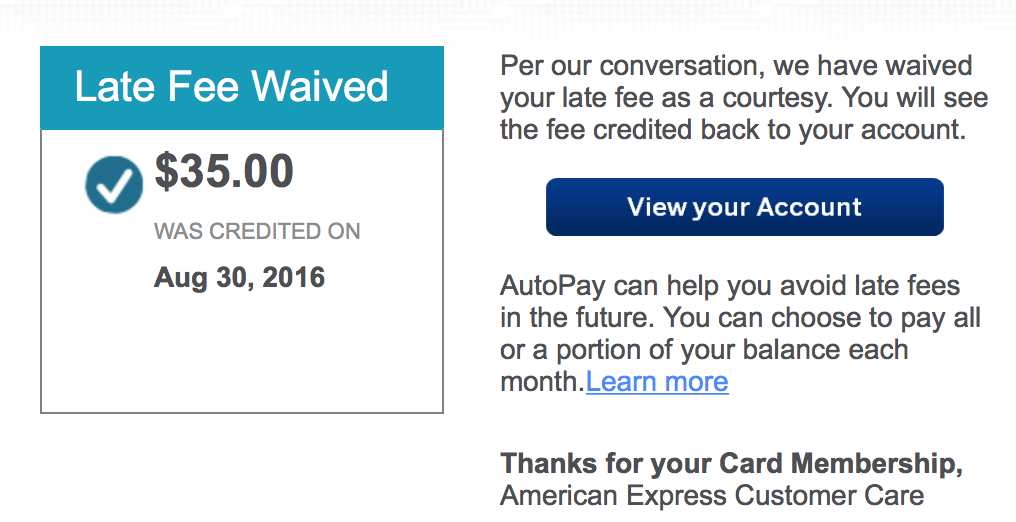

Given my excellent track-record with American Express, I made a 3 minute phone call to AmEx and had the fee reversed as a courtesy.

Getting the $35 + small amount of interest fees back sure was a relief, and to prevent it from happening again, I’ve now activated auto-pay on that account.

Have you ever incurred an accidentally late fee and had it successfully reversed?

I did once. but don’t remember any details.

A somewhat related recent incident was a recent $1.50 minimum interest charge from BOA (Alaskan card). I paid had paid all the balance before the statement was due, and maybe some before it hit statement (to keep the balance down). I called, more out of curiosity than the $1.50. After entering the card number the automated service said it saw a minimum interest fee and could waive I hit 1 (or whatever). I did and dropped the issue.

Yes, unfortunately I had a bill get lost in the mail and never arrive. I was able to get all the fees refunded by using the Amex chat feature, no need to call in.

I haven’t ever paid a late fee. However, I have all my credit cards automatically debit my checking account. I still receive statements every month, but they say “Do not pay” and tell me when the money will be taken out. I have been doing this for years.

I normally pay off every card in full each month, but I’ve had it happen a couple of times. When you have kids, life gets in the way sometimes. As much as I want to set up automatic payment of the minimum of every card (as a safeguard, just in case), a few cards here and there slip through the cracks.

Because I (almost) always pay on time and have a good history with the banks, I’ve always been successful in having them waive the fee. Be careful though, sometimes they don’t unwind the interest charges that occur from not paying your card off in full by the due date. You may need to call back and ask them to waive the associated interest as well.

I’d watch out next month for the interest charges on the late fee too. Had that bite me even after I got late fee removed. Helped to overpay balance and then ask for credit, in my experience

Sadly I have also done this many times. I found that Chase’s customer service is super helpful – replacing the late fee in full each time. I also called Chase, and they told me that they wait 30 days before reporting the missed payment to the credit agencies. So even if you miss the payment by a few weeks you will still be good credit score wise! Thanks for the great tip.