As much as I’d like to give myself a cool title such as “certified deals and bargain master”, I am the furthest away from considering myself a financial advisor or an “expert” in any capacity. However, I am pretty certain about these 3 things: 1.) I have lots of credit cards, 2.) I pride myself on having pretty awesome financial habits and organizational skills, and, most importantly, 3.) I like love traveling with points and miles.

When I share point #1 with others (having lots of credit cards), 9/10 times, I get looks of horror. “Credit cards are B-A-D news”, they say. Responses like that make my blood boil, because for many years, I’ve had a pretty darn rewarding relationship with my plastic, thankyouverymuch. Sigh, some people just don’t “get it”.

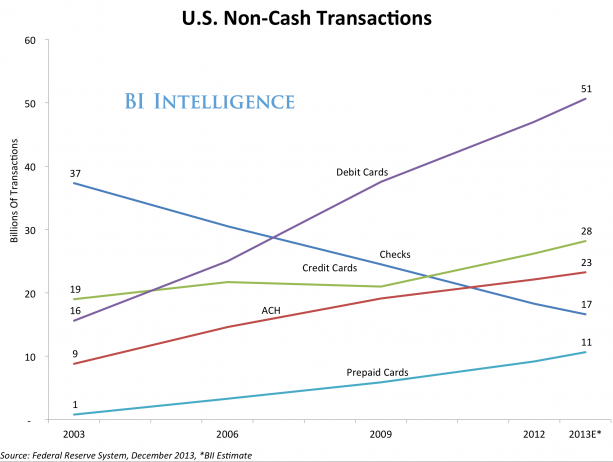

51%

I’ll admit that when I came across the graph below (which I found on TBB), I was shocked, but at the same time I “got it”. 51% of non-cash transactions last year came from the use of debit cards. Ouch – all I can think about are the billions of unearned points and miles.

Call me a harsh person, but I can’t help it – IÂ judge cringe, when I see people use debit cards on a day-to-day basis. Yes, I “get it” that people have various reasons for doing so, but assuming they are financially responsible to begin with, why not earn valuable rewards and build credit at the same time?

Over the last few decades, credit cards have been slapped with a bad reputation because of how easy it might be to rack up massive amounts of debt. This post is not intended for people who spend outside of their means or don’t use credit cards properly to their advantage. I would never recommend a points-and-miles-earning card to anyone who can’t pay their bills on time and in full each month because the fees and consequences outweigh any kind of travel-reward benefit by any means.

The Case of Target

By now, it’s safe to assume that we are all aware of Target’s recent security breach, and numbers have climbed from 40 million affected to a whopping 70-million people affected.

Sadly, many people who have unfortunately suffered from fraudulent charges and compromised account information were debit card users. While it’s safe to assume that most who were affected will be let off the hook for unauthorized charges, debit card users are already facing bigger headaches simply because consumer protection laws view debit and credit cards differently.

Banks Care About Their Money More Than They Care About Yours

It’s a fact that debit cards offer consumers fewer rights in the case of unauthorized purchases, come with a much greater risk of being responsible for potential liabilities, have much longer dispute resolution times, and less purchase protection (if any).

In the case of credit cards, when an unauthorized charge is reported, it’s often credited back to your account immediately, and a provisional credit is issued while the bank investigates the potential loss of their money. On the other hand, debit cards deal with your money. Let’s face it – banks care about their money more than your money, and that’s why it can take up to two weeks for the bank to conduct their own investigation about the fraud before reimbursing your account.

In the case of lost or stolen debit or credit cards, federal law caps off the total potential losses to a maximum of $50. However, in the case of debit cards, you must notify the bank within two days of the loss or theft of the physical card in order to qualify for the “protection” (you have 60 days to report an unauthorized charge if just the number is stolen) or else you could be responsible for up to $500 in fraudulent charges, regardless if they’re yours or not.

I <3 My Credit Cards

In general, credit cards offer far more consumer-protection benefits that I’m sure most of us in the points and miles world have used at one time or another. For instance, I broke my iPhone twice, and Chase was able to save me. American Express also offers a very generous “no-questions-asked” 90-day purchase protection plan. I’ve gone through my own experiences just months ago when I discovered fraudulent charges on my Chase Sapphire Preferred, and Chase handled it like a pro. I feel good knowing that the credit card companies “have my back” in sucky situations that are out of my control.

Relevant to the travel world, a good number of Chase products offer a pretty sweet trip delay/cancellation protection benefit, and I never ever shill out extra money for rental car/auto insurance policies because my American Express Platinum card automatically comes with a great coverage policy when I use the card during booking. The list goes on and on…

Parting Words

I know that any kind of financial discussion is like opening a can of worms, and I know very well that people will always have different views on their payment preferences all together based on their individual scenarios. This post is solely my opinion on why I will always choose a credit card over a debit card until the end of time.

The floor is open to discussion…

Let’s connect: Twitter | Facebook | Subscribe | japt.co

It’s plain and simple – if you are not financially responsible, then whether you spend with Debit or Credit, you will be in trouble one way or the other..

and if you are responsible, then you don’t need to worry about raking up debt on the CC-you won’t..

I see a lot of my financially responsible friends also use Debit cards/cash for transactions.. I think the reason is that there is an inherent distrust towards CC and CC Companies/banks.. just because they have a high interest rate, people think the CC companies will try and rip them off and charge them for something or the else.. Oh the naivety..

Spot-on. My debit card is used to ATM transactions only. Unsafe to use it for anything else, even if you aren’t trying to collect points.

True. Life. Story.

I completely agree with this everything in this article. I cringe as well when I see people using a debit card.

However, there are people who don’t have the credit to get a CC. When I was a freshman in college, I only had one CC and it only had a $500 limit so for large purchases, I had to use my debit card. I eventually got the AA card with a high enough limit to never use my debit card again.

I would also agree with the distrust about credit card companies and horror stories about how people get into debt. This is what most people hear so will shy away from CC’s. Its just fear of something they don’t understand. If you’re responsible, credit cards is the only way to go. Much better security wise, despite the Target incident.

Debit cards have the same fraud protections as credit cards.. Hello.. when used as a credit card (no pin).. it is a credit card with the same visa/MC protections… that is what the little insignia on the front of the card means. So much fraudulent information is this post.

Uhh no Kara. This post is right on about better fraud protections using credit cards vs debit if you have fraudulent charges hit your account. I have had $9,000+ in fraudulent charges hit my credit card. Since it was a credit card, my checking account remained untouched and charges removed when this was discovered about a week after the charges posted.

If this was a debit card I would have had $9,000+ in my checking account withdrawn, then have to deal with the bank to restore funds and reverse NSF or overdraft fees plus any fees incurred by billers for writing a bad check. And what if this happened over a weekend? Ask your bank how long it will take to restore funds. The answer is likely the next business day. Just hope your purse or wallet with debit card isn’t stolen on a Friday evening of a three day weekend.

We haven’t even touched on the topic of funds holds when using debit cards at gas pumps, restaurants, vending machines, etc. But that’s not relevant to this post.

Plus.. How about the proven fact that credit card users spend on average 30% more per transaction vs those that use cash? You don’t have the same emotional response when using plastic vs cold hard cash and make more impulse purchases… I’ve never a millionaire credit the reason for their success to their “points and miles”.

Totally agree. Before getting into travel hacking, I actually was using a pseudo-Dave Ramsey style envelope system (using cash for almost everything). I think that does help to generate better budgeting skills (since with cash, if you don’t have the money, you don’t have the money).

Now though we only use our debit card when we shop at Aldi (which doesn’t take CC)

I don’t have a debit card either (but I do have an ATM card.) I normally shy away from telling my friends that they shouldn’t use debit cards since it’s their choice to do so and who am I to judge? However, whenever they ask why I have 5 credit cards, I’ll gladly explain to them the whole miles/points game and what not. Most are intrigued and always ask me how to get a points credit card but for some reason only 10% of them follow through. Why? I have no idea but it is their choice.

The whole miles/points game was so different 10 years ago when most of my friends were introduced to the world of credit — this was the time before the megabonuses of 50k/75k/100k intro offers. Most of my friends, including myself, got our first credit card at freshman orientation in college when the biggest thing to get was a 0% APR credit card for 1 year. Back then I don’t even recall the Chase Sapphire card or any sort of Ultimate Rewards programs, etc. Anyway, I think it’s partly due to the college experience (where most students incur credit debt) as a reason why a lot of adults shy away from credit cards.

Nowadays, I think a better way of explaining to my friends why I have several credit cards is because I treat them like charge cards: I always pay them in full at the end of each month and never leave a balance. Period. Oh and the bonus intro points thing is quite addictive too ;)

Absolutely nothing wrong with using debit cards. Some of us buy and burn through dozens a week. Never look a gift horse (or card) in the mouth. :)

When I have the option, I request both a debit and ATM card. I carry my ATM card for the cash withdrawals and occasional purchase when I need cash back.

The debit card is still useful for international ATM withdrawals, as in my experience, the ATM only card is often rejected because it is not recognized as a valid Plus or Cirrus system card, whereas a Visa or MasterCard card is.

I still use a debit card for a teller based “cash advance” when I need to withdraw a large amount that would be greater than my ATM limit. My bank does not charge for this, although many of the big banks do so since they know this is a way to get around ATM fees.

Yup, I love my credit cards. I get the same reaction too when I use my credit cards (about racking up debts or maxing out credit), but I am a financially responsible person and I watch my account like a hawk. I have seen some people put large purchases onto their debit card and I cringe thinking about how many points/miles they are missing out on. Then again, these are the people who ask how I can afford to travel every year in business or first…

I try and use a debit card every day at WM. And I’m surprised you aren’t using one too. But for every day spend elsewhere, it’s always with a CC…

I think there is one area you are leaving out with respect to debit cards. I put everything I can on a credit card and then pay it off with my Sun Trust Delta debit card (earning at minimum 2x miles) on every credit card transaction. But I also use that account to load my Bluebird and pay my bills from it earning miles every time I swipe to load. If you aren’t earning miles on literally everything spend money on (including mortgage, car payments, insurance, phone bill, etc,) then you leave a lot on the table. When you factor this in, you can easily add another layer of mileage earning to your repertoire and gaining a ton of miles in categories often disallowed by credit cards. Why would anyone leave these miles on the table? I think your point is on the mark, but I encourage you to not just earn on all credit transactions but on EVERY transaction.

To those that have ATM cards, how did you get them? Every bank I use will only offer Debit cards. Finding a plain ATM card is extremely difficult anymore.

@Angelina — if you don’t use Debit/ATM cards, how do you get foreign currency when you’re traveling?

Also, I love chocolate. If I have some around, it goes fast as I don’t have much willpower against it. It is my Kryptonite. For some people, their Kryptonite is credit cards. Instead of judging, maybe realize we’re all different and some people are better about spending than others. Educate your friends about their options, but then let them make their own choice.

Not true. Most if not all banks should be able to provide an ATM only card but you must request this as the bank certainly has no incentive to offer an ATM only card. In my experience with two banks they shifted to allow you only one card (ATM or debit). My credit union made me give up the debit card to “downgrade” to an ATM only card. Online banks and brokerages may not offer an ATM only card.

What annoys me more is that when I’ve requested an ATM only card the rep or banker will say that your debit card is an ATM card and I should keep a debit since it’s accepted in more places. I politely reply that it’s (in theory) more secure since it requires a Pin and cannot be used online. Also if funds are stolen because of fraud there’s a hassle for both of us to get my funds back and reverse any NSF’s. That usually ends the conversation right there!

I agree 100%. And like an earlier comment said, I too only use my debit card to take cash out of the ATM. That’s it. EVERYTHING else I use my credit card. If only my baby’s daycare would take credit card… tried, but failed, even though they’re a huge company (Bright Horizons), but it’s a no go.

I cringe more when people literally write a check to pay at the register. All the same missed point opps & disadvantages of a debit card, PLUS it takes 3x as long to pay, PLUS they’re physically giving out account#, address, and who knows what else (ppl print the stupidest things on their checks — like SS# and DL!). One thing to swipe your card on a machine that encrypts data, another to have it on a paper floating around a store full of low-wage workers.

Well as we know at Target and other retailers with encryption or not the data may still be stolen. And when I buy cold medicines I use a passport card for ID since it cannot be swiped like a drivers license.

When I was younger, I used my PayPal debit card for everything. I thought 1.5% cash back on the things I was buying was awesome. After earning a few hundred bucks in cash back, I started getting more and more credit cards since the rewards and sign up bonuses were much, much higher. Credit cards are like tools on a tool belt or in a tool box. Everything has a very specific purpose. The more tools, the easier to finish “the job.”

Wait wait wait.

@Sherpa – You can pay off your credit card with a debit card? How does that work?

As someone who works for a big bank, that issues many cards that are talked about on this website and others, I have to tell you, I haven’t used MY debit cards since 2009. Just saying, if the guys who work for the banks don’t do it, maybe you shouldn’t either…

Miles – I am writing a post that comments on this, I will share the link with Angelina’s permission. She did a great job on the CC part of things, I just want to show you the process for getting miles on everything.

Miles, others –

Here is a post about using a debit card to pay your bills and earn miles.

http://bitly.com/1dDqnmR

@Kara: I’m sorry but I disagree. Even when you process a debit card as “credit” without entering a pin, credit cards and debit cards do NOT have the same protection. Commenter AskMrLee did a good job explaining that. In regards to spending 30% more on a CC, I also disagree – the only time I can think of when I would pay a higher price on a CC vs. cash in my everyday life would be at the gas station, where it’s typically 10 cents more per gallon. Oh, and at Aldi (grocery store).

@Joey: I agree that the bad reputation comes from the college experience as well! I remember when I was in college, it was “cool” to sign up for a card on campus and get a free tshirt as a sign-up bonus. None of us really knew what we were doing. I hope today’s youth can educate themselves better than my college generation was able to.

@AskMrLee: I agree – I use my debit card only at international ATMS… and also for “cash back” purchases at CVS or a similar store when I know that there will be an ATM fee and I’m needing cash. I’d rather get a pack of gum for 89 cents and some cash than pay ATM fees.

@Paul: I agree that debit cards for manufactured spend is a good thing! Howver, I wish I had more time do to the BB/WM thing :) For everyday transactions, CC is the way to go :)

@Sherpa: Love your technique!

@Marina: I agree – education is key. I always try to point my friends and family in the right direction and it’s up to them to make their own choices.

@Claire: I agree! Checks are the worse… so glad they are on their way to becoming extinct!

@Grant: Well said- your comment reminded me of the time where I made a 30K$ purchase YEARS ago on my Amex Blue Sky… oh if I can turn back time LOL. I agree that credit cards are like “tools” – some are better for others in certain categories.

HI Angelina,

I’m in the camp who doesn’t own a credit card and never will. I am well aware of the of the benefits of using credit cards, etc. My problem is that I don’t like being in any kind of debt. Period. I went to a private college and unfortunately have enough debt to last a lifetime. That means the only debt I ever want to be in is to my college or lenders of my student loans. I pay for EVERYTHING in CASH or use my debit card. That means every trip flight I’ve ever purchased, every hotel I booked, and every car I rented was paid for using cash and I’m pretty proud of that.

(And like you, I’m a budget traveler. Most of the places I’ve traveled to including Trinidad, Mexico, and Bahamas were either free or highly discounted because I enter every contest possible to win these trips. Therefore, I don’t think I’m missing anything by not owning a credit card. )

Plus, as a credit union member, I earn 4% interest when using my debit card which is much better than the .00006 percent many banks offer these days.

Now, I’m not coming down on you for owning a credit card. These are just reasons why I don’t see the need to use one.