If you’ve been a long time reader, then you already know that I am a huge fan of Ultimate Rewards points. The majority of my award redemptions for aspirational and “dream” destination trips have been made possibly by using Ultimate Rewards. Some redemptions include my stays at the Park Hyatt Maldives, Park Hyatt Tokyo and the new Andaz Maui. The airfare for my recent family vacation to Maui, and my first class trip on Singapore Airlines to Sydney last year have also been made possible thanks to Ultimate Rewards – it’s definitely a program I plan to keep high on my list for a long time.

Though many people associate Ultimate Rewards points with just the Chase Sapphire Preferred card and the Ink Plus/Bold cards, there are actually six Chase cards that earn Ultimate Rewards points. I talk a lot about Ultimate Rewards because they transfer 1:1 to United Airlines, British Airways, Korean Air, Southwest Airlines, and Virgin Atlantic miles or Hyatt points. Their flexibility lets me save for many dream redemptions at once.

Now I’ll share with you what I think is the best trio of Ultimate Rewards that work together to maximize every day spending to get you on your dream trip faster.

The Three Families

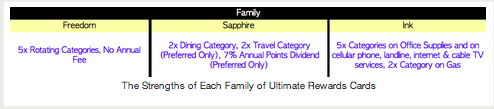

I think of the six Ultimate Rewards earning cards as belonging to three “families”: Freedom, Sapphire, and Ink.

Other than their names, the key differences between the families are their category bonuses and whether they contain personal or business cards.

Freedom Family (Personal): 5x on Rotating Categories

The Freedom family has only one card: Chase Freedom.

The Chase Freedom earns 1 Ultimate Reward per dollar on all purchases, and 5 Ultimate Rewards per dollar on a set of rotating categories each quarter. From April 1 – June 30, 2014, you can earn 5 Ultimate Rewards per dollar at restaurants and Lowe’s stores.

Sapphire Family (Personal): 2x at Restaurants

The Sapphire family has two cards: the Chase Sapphire and Chase Sapphire Preferred.

The Chase Sapphire card earns 2 Ultimate Rewards per dollar at restaurants and 1 Ultimate Reward per dollar on everything else.

The Chase Sapphire Preferred earns 2 Ultimate Rewards per dollar at restaurants and on travel purchases and 1 Ultimate Reward per dollar on everything else.

Ink Family (Business): 5x at Office Supply Stores and on Telecom Bills, and 2x at Gas Stations

The Chase Ink family has three cards: Ink Plus, Ink Bold, and Ink Cash.

All Chase Ink cards earn 5 Ultimate Rewards points per dollar at office supply stores and on cellular phone, landline, internet and cable TV service and 2Â Ultimate Rewards points per dollar at gas stations.

The Ink Plus earns 2 Ultimate Rewards points per dollar at hotels. The Ink Cash earns 2 Ultimate Rewards points per dollar at restaurants.

All other purchases earn 1 Ultimate Reward point per dollar.

The Strengths of Each Family

Each family of Ultimate Rewards earning cards has very different strengths, so I strategically have one card from each family to fully maximize their advantages.

To maximize the strengths of each family at the lowest cost, I recommend this combination of cards: the Chase Freedom, Chase Sapphire Preferred, and Chase Ink Cash.

If you hold all three, you’d have the following category bonuses:

- 5x at office supply stores (Ink Cash)

- 5x on cellular phone, landline, internet and cable TV services (Ink Cash)

- 5x on categories that rotate every quarter, which are restaurants and Lowe’s from 4/1/14 to 6/30/14 (Freedom)

- 2x at restaurants (Sapphire Preferred)

- 2x on travel (Sapphire Preferred)

- 2x at US gas stations (Ink Cash)

- 2x at restaurants (Ink Cash)

That’s an impressive list that combines the strengths of each family of Ultimate Rewards cards and will allow you to rack up the points every day.

The Chase Freedom, Chase Sapphire Preferred, and Chase Ink Cash combination also ensure that all your Ultimate Rewards are transferable to airlines and hotels while minimizing your annual fees.

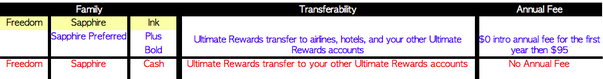

Transferability

First things first: not all Ultimate Rewards are equal.

The Chase Sapphire Preferred, Chase Ink Plus, and Chase Ink Bold are the only three Ultimate Rewards cards that earn Ultimate Rewards which can be transferred directly to hotels and airlines. But they also come with a $95 annual fee after the first year’s introductory $0 annual fee.

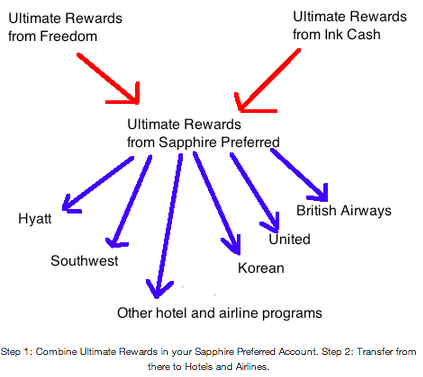

The Transferability Trick

The Chase Freedom, Chase Sapphire, and Chase Ink Cash earn Ultimate Rewards that cannot be transferred directly to hotels and airlines.

For me, all the value of Ultimate Rewards comes from their ability to be transferred to hotels and airlines.

The good news is that all Ultimate Rewards can be transferred freely between your Ultimate Rewards accounts.

That means if you have the Chase Freedom and the Chase Sapphire Preferred, you can transfer Ultimate Rewards online from your Chase Freedom account to your Chase Sapphire Preferred account.

Once the Ultimate Rewards are in a Chase Sapphire Preferred account, they can be transferred from there into airline and hotel accounts.

So you can see why I recommend having the Chase Freedom, Chase Sapphire Preferred, and Chase Ink Cash.

- The Chase Freedom and Chase Ink Cash have no annual fee, so you minimize annual fees.

- You can use each card with its unique and awesome category bonuses, so you maximize everyday spending.

- You can transfer your Ultimate Rewards from your Chase Freedom and Chase Ink Cash cards to your Chase Sapphire Preferred account. With all the Ultimate Rewards in the Chase Sapphire Preferred account, you can then transfer your Ultimate Rewards to airline miles and hotel points, so you maximize the Ultimate Rewards transfer partners.

Sign Up Bonuses

Today’s post is really about the best combination of Ultimate Rewards cards for everyday spending, so I haven’t even mentioned the cards’ sign up bonuses.

- Chase Sapphire Preferred:Â Earn 50,000 Ultimate Rewards points after you spend $4,000 within the first 3 months of card membership.

- Ink Cash Business Card:Â Earn $200 bonus cash back (20,000 Ultimate Rewards points) after you spend $3,000 in the first 3 months from account opening

- Chase Freedom: (limited time) Earn $150 bonus cash back (15,000 Ultimate Rewards points) after you spend $500 in the first 3 months of card membership.

What combination of Ultimate Rewards cards do you use to maximize every day spending?

Let’s connect: Twitter | Facebook | Subscribe | japt.co

Interesting perspective. Very practical but if we are talking about two people like spouses then I will modify this approach. One spouse should keep Chase Sapphire and the other one Ink Plus. Points can be shared between the two as long as it is the same address.