As the year nears its end, I am finally asking myself a serious question: What on earth am I going to do in terms of having United status next year? I’m not going to lie – I’m pretty spoiled comfortable as a 1K, though this is definitely looking like my first and only year as a 1K (thanks to United’s sly move towards becoming revenue-based). It was a fun ride to say the least.

My favorite “perk” of having top-tier status is the ability to redeposit award tickets without paying a fee, and in theory, I can redeposit an award within minutes of departure time (theory tested and proved). That alone allows me to be spontaneous in my travels.

Let’s take this weekend for example. A work commitment in Chicago came up with days notice. As much as I hate redeeming United miles for short-haul domestic awards, it sure as hell beats paying astronomical last-minute prices.

I booked multiple United award possibilities as “placeholders”. In the end, Avios saved the day (a much better redemption – 7,500 Avios vs 12,500 UA miles for EWR-ORD), and I was able to cancel my United bookings for a full mileage refund.

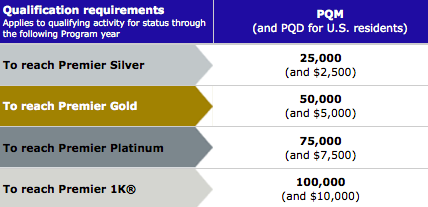

Starting next year, United will require you to fly a certain number of miles and pay a certain amount for United tickets to achieve status:

Folks who buy cheap ticket will find that they meet the miles (PQM) requirement but not the spending (PQD) requirement. For these people, a United card is essential because spending $25,000 on the United MileagePlus® Explorer Card will waive the spending (PQD) requirement for the year for Silver, Gold, and Platinum status.

As much as I hate the new PQD spend requirement for 2015 (effective now for 2015 earning), as well as the terrible new-RDM earning structure that’s about to kick in March 1, 2015, I am kind of in a pickle. I’m thinking of Platinum as my status goal for next year.

I’m EWR based so it’s really hard to just cold-turkey “break up” with my beloved United.

Platinum status is a good end goal because I still get the no-fee redeposit awards perks as well as the complimentary upgrades that I love. There’s nothing that makes my day brighter than seeing the “you’ve-been-upgraded” email in my inbox before my flight.

Going back to my example from this week, I received a lot of those emails. Even on award bookings (I ended up not taking any of those flights though). And that’s thanks to my United MileagePlus® Explorer Card. One not-so-talked-about perk of that card is that you can receive complimentary upgrades on some award tickets.

I got the card last year and I decided I’m keeping it. Since I won’t be spending $7,500 on United flights to qualify for Platinum, I figure I will rack-up $25,000 spend on my Explorer card so that PQD requirement is waived. I’ll also get 10,000 additional miles by reaching the $25,000-spend threshold.

Other major benefits of having a United card include:

- extra award space normally set aside for United elites

- never having your United miles expire

- a free checked bag for you and a companion

- priority boarding on United flights

- 2 United Club passes each year. The clubs are a nice place to relax with plenty of space, free wifi, and free snack and drinks  United sells identical passes for $50, so this benefit has a $100 retail value.

- waiver of a big impediment to getting United status

- no foreign transaction fees – use it abroad.

- earn 2 miles per dollar on United purchases and 1 mile per dollar on all other purchases.

- Each calendar year that you spend $25,000 on the card, you get a 10,000 mile bonus. That’s like getting 1.4 United miles per dollar on all purchases. (35,000 miles / $25,000 spent)

- and… those complimentary upgrades on award tickets I’ve mentioned above. (only if you’re an existing elite though).

Not only does the United MileagePlus® Explorer Card come with a nice increased sign-up bonus, but its benefits pretty much mimic United Silver elite status for only a $95 annual fee, which is waived for the first year anyway (which is also good if you don’t have 25,000 miles of flying planned for this year + spending $2,500 on those United tickets).

Who Can Get The Card

If you’ve never had the United MileagePlus® Explorer Card before or you last got the bonus at least two years ago, you can get this card. From the offer details:

“This new cardmember bonus offer is not available to either (i) current cardmembers of this consumer credit card, or (ii) previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months.”

Being the authorized user on someone else’s United card account does not stop you from opening the card for yourself and getting the bonus for yourself.

Using the Miles

United miles are the easiest miles to redeem of any major airline. You can redeem the miles for United flights or flights on any of the other 26 Star Alliance airlines, which fly all over the world.

Conventional wisdom has turned too sharply against United miles since United made its award chart more expensive in February of this year.

Conventional wisdom has turned too sharply against United miles since United made its award chart more expensive in February of this year.

Economy awards on United and its partners barely went up in price. BusinessFirst and Global First awards on United are still at manageable prices. However, partner business and first class awards went up in price sharply.

Stick to redeeming miles for economy awards or United’s own premium cabins, and you’ll get excellent value from your United miles.

Bottom Line

The card also with a ton of benefits when flying United that mimic elite status.

United is a member of the largest airline alliance, and United miles can be used on over 30 airlines that serve every inhabited continent.

Application Link: United MileagePlus® Explorer Card

So there is is. I’m keeping the card for at least another year with United so I can achieve Platinum status to allow me to have the freedom of booking “risk-free” award tickets. That’s the fuel to my ever-burning desire to travel spontaneously.

Do you have a similar strategy with this card?

There’s another link floating around that offers all of the above plus a $50 statement credit. I have no experience with that application so YMMV.

Also, PQD requirement started in 2014 for status qualification, there are no changes there next year as far as status qualification.

I’m not good enough at MS to make $25k spend, and I have Aegean Gold for all my Star Alliance elite status benefits. Not sure it’s worth it for me! At least I have Silver for 2015 but I doubt I am re-qualifying due to PQD. Perhaps I can convince Chase to give me a retention bonus though?

Best public offer you have seen??? Here’s an even better one: https://www.theexplorercard.com/50k50AFWICLTO

I am sure myself and your loyal readers can count on you to update the post by removing the offer that doesn’t give the statement credit and replacing them with the superior offer! :)

Thanks FreeTravelGuys & Hua – I have updated the post withe the offer with the additional $50 statement credit. That offer was showing an error message/appeared to be pulled a few days ago, but as of the update now it looks like it is live again! :)

@Michael Wu: I am terrible at MS too, but it makes sense for me to do it (unless I move to Canada and or run away and marry someone in the military, LOL). It never hurts to ask for a retention bonus! Let me know what they offer you.

@oleg: Yup, you are correct. the PQD change started this year for 2014 for 2015 status. Perhaps I will update the language in the post to steer away from confusion.

@hua, it’s important to know that some of these offers aren’t advertised and people happen to “catch” them online, but they’re never technically 100% guaranteed so one always should be cautious when applying and taking screen shots as it’s always a bit of a gamble.

Your post is a little misleading. Just having the Explorer Card without any elite status

Will not ever give you an upgrade, either on a paid flight or an award flight.

You must have at least Silver to try for upgrade, but your chances are slim to none!

The new UA RDM earning scheme starts 3/1/15 not at the beginning of January.

http://mileageplusupdates.com

@Richard and Tom: I’ve updated the post with the correct information, Thanks!

I am curious about my situation. I currently am Silver with mileage alone and have just met the 25k spending as well. Will this bump me up to Gold?