Rumor has it that there’s allegedly a new Chase product coming next month, The Chase Freedom Unlimited, that will replace the existing product that we know (and I love) today.

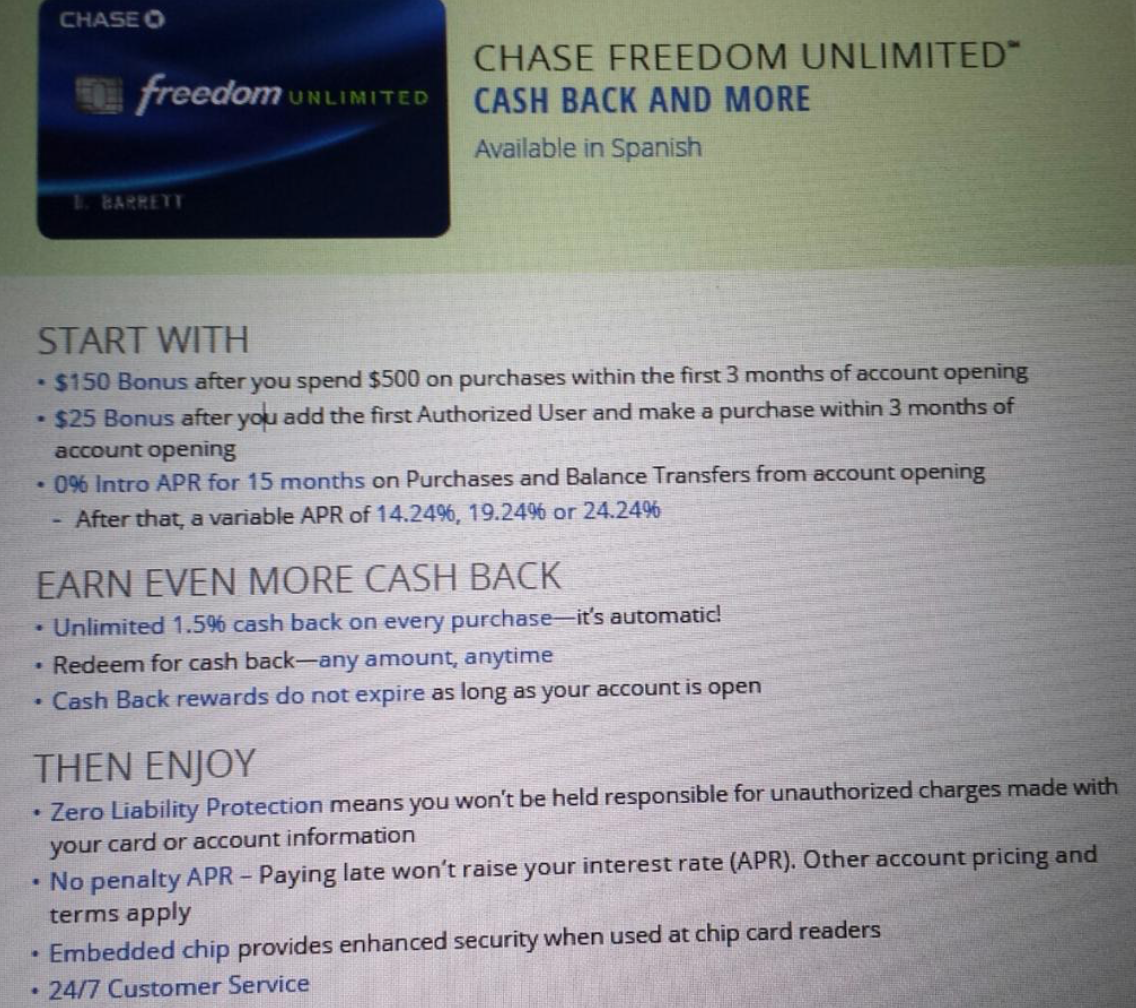

This is what it will supposedly look like:

The improvement is that there will be the ability to earn 1.5% cash back on every purchase, but notice how there’s no mention of the 5x rotating quarterly bonus categories, a feature that I consider to be the absolute most valuable component to the card (last quarter you even had the ability to earn 22,500 bonus points at Amazon.com!)

What’s also uncertain is that there’s no guarantee that the new product will offer “cash back” in the form of Ultimate Rewards points that can be combined with the amazing and flexible Ultimate Rewards points from the Sapphire Preferred and Ink products (learn more about the “trifecta” here).

Strong rumors say that this product will be replaced immediately in all Chase branches by March.

What will happen to existing customers?

The good news is that I’m told existing customers who have the old Freedom card will stay in the existing product (whew, a card I will keep forever).

The bad news is that while the new Freedom Unlimited card appears to be an better “everyday” cash back card than it already is (1.5x vs 1x), the removal of the 5x option really hurts our ability to work towards free travel.

What now?

Pat yourself on the back if you have the original Freedom card. If not, it is highly recommended that you consider getting the no-annual fee card that offers 5x on rotating quarterly bonus categories.

Bottom Line

- Rumor says that the existing Chase Freedom will soon be replaced by a new Chase Freedom Unlimited product in Chase branches.

- Rumor says it that this will occur sometime in March.

- Rumor says that existing Freedom cardholders have nothing to worry about.

- Angelina says that the existing Freedom is a better fit for miles and points hobbyists, so…

What are your thoughts?

Where is the screenshot from? Not they I don’t believe you, just curious.

Angelina can’t give away all of her secrets ;)

;)

whats with the begging?

Begging for what?

I don’t believe for one second that Chase will grandfather the old Freedom cards for long. This already happened once when they converted everyone’s “Chase Cash Rewards” cards to Freedom against our wishes. That was my favorite card, giving me 5% on ALL spend at gas, grocery, drugstores with no limits (at least, none that I ever hit), and one day I simply received a letter in the mail from Chase saying that they were replacing it with the (inferior) Freedom card. So now they’re gonna do it again, removing the last usefulness the card still had. Whatever.

I also agree that there will be no lifetime grandfathered benefits… :(. Reminds us when they took away the 7% points dividend on CSP as well.

The fact that Chase has to come up with new categories quarter after quarter really puts a limit on how long the old Freedom will persist. How long are you going to pay to maintain a quarterly signup system, complicated coding and flashy graphics for a card no one new can get?

It may simply be a new product. Freedom Unlimited?

For the average user the 1.5% is better anyway. We’ll see what happens to the rotating categories though, but those didn’t add up to all that much. If only they made freedom 2x across the board, I’d be putting A LOT of spend on it.

I agree. Across an entire year, most consumers will probably come out ahead with 1.5% vs 1%/5%. Not many people are maxing out $1500 in gas purchases per quarter so the actual payout is pretty low.

I have had 2 of these this cards for a very long time as they morphed from other cards. If it were not for the hits to credit record I would cancel them with these changes. Back of the sock draw they will live.

I’ll bet it’s just a separate card, not intended to replace the Freedom. Perhaps meant for those whose credit isn’t good enough for the Freedom? Just like Apple tried to reach the masses with the iPhone 6c, maybe Chase is adding a “poverty card.” :-D

Rotating categories that one had to register for and a $6000 annual spending cap for the 5% rewards limited the appeal of this card. The 1.5% cash back puts it head-to-head with the Capital One Quicksilver card which will likely still have more appeal with no foreign exchange fees. Since both are issued by Visa, they might be useful at Costco later this year if you are not a frequent Costco gasoline customer.

Why would you want a 1.5% cash back card when there is a 1.99% cash back Citi Double Cash available?

1.99%?

I am Chase Private Client level, and get ‘executive line’ customer service when I call.

According to them the facts here aren’t correct with respect to the fate of the Freedom 5%.

They said they have been getting questions about this and say both cards will be marketed, and the Freedom Unlimited will be a separate, side by side product. There will be no elimination of the 5% Freedom for existing or new cardholders.

Never take what a branch guy tells you – they are the most out of the loop.

And Chase made public today that the speculation about the 5% Chase Freedom in this blog post is incorrect.