People think I am crazy for having a collection of hotel and airline co-branded credit cards, but let’s face it – with so many program changes over the years, it’s becoming increasingly-difficult to earn elite status simply by flying.

In my case, it was a pretty painful blow going from United 1K to Mileageplus “member†all within a span of a little over 12 months. Now without any airline status what-so-ever, facing checked-bag fees is a real issue for this household.

The good thing about many co-branded airline credit cards is that they come with perks that pretty much mimic elite status benefits for a nominal fee. With that being said, I have no problem having many different airline credit cards because the benefits over the course of the year outweigh any annual fee by far.

As someone who has only flown with JetBlue a handful of times in the past, the airline is now on my radar. Thanks to not only their consumer-driven and fun culture with great in-flight amenities (free “FlyFi” and onboard snacks), but the real push for me is one of their new, enticing credit card products. How’s that for “reverse inspiration”?

Introducing the New JetBlue Cards

I’m excited to announce that I had the opportunity to be one of the first people to be introduced to the three new JetBlue credit cards from Barclaycard!

This is a brand new and exciting relationship between JetBlue and Barclaycard, and it’s refreshing to see that they’ve rolled out three very impressive new credit cards (not to mention they are a tremendous improvement to the previous cards in the past)!

JetBlue Card

Perfect for people who love JetBlue and also want an everyday credit card that offers great value.

(offer currently being updated)

JetBlue Plus Card

Perfect for the avid traveler who loves JetBlue and wants even more out of their JetBlue experience. The card has a $99 annual fee.

- Earn 30,000 bonus points after you spend $1,000 on purchases in the first 90 days

- Earn 6 points for every $1 spent on JetBlue purchases; 2 points for every $1 spent at restaurants and grocery stores; 1 point for every $1 spent on all other purchases

- Free checked bag for the primary cardmember and up to three companions on the same reservation when you use your JetBlue Plus Card to purchase tickets on JetBlue-operated flights $99 annual fee

- Enjoy Mosaic benefits for one year after you spend $50,000 or more on purchases after your anniversary date

- Get 10% of your points back every time you redeem to use toward your next redemption

- No foreign transaction fees

- $100 statement credit after purchasing a JetBlue Getaways vacation package of $100 or more with your JetBlue Plus Card, available once every year

- 50% savings on eligible inflight purchases like movies, cocktails and food

- Chip-card technology

- $0 Fraud Liability protection

- Earn 5,000 bonus points every year after your account anniversary

- Special travel and purchase protection benefits like 24/7 travel assistance and concierge service, travel accident insurance, car rental protection, trip cancellation and interruption insurance, baggage delay insurance, purchase security, return protection, extended warranty, Global Assistance Services, identity theft helpline and more

- All the benefits of the TrueBlue program: No blackout dates on JetBlue-operated flights; points in your TrueBlue account don’t expire; unlimited earning; Family Pooling of TrueBlue points

As part of the World Elite MasterCard program, JetBlue Plus Card members also have access to World Elite Travel Services:

- Enjoy access to a suite of benefits, amenities and upgrades including premium travel offers from the best in class travel companies, world-class travel advisors and access to “Priceless Experiences.â€

The JetBlue Business Card

Perfect for small business owners with special perks like an embossed business name, employee cards, employee account controls, individual online statements, consolidated annual report, downloads to business software, Global Assistance Services, and an identity theft helpline. The card has a $99 annual fee.

- Earn 30,000 bonus points after you spend $1,000 on purchases in the first 90 days

- Earn 6 points for every $1 spent on JetBlue purchases; 2 points for every $1 spent at

restaurants and office supply stores; 1 point for every $1 spent on all other purchases - Free checked bag for the primary cardmember and up to three companions on the same

reservation when you use your JetBlue Business Card to purchase tickets on JetBlue-operated

flights - $99 annual fee

- Enjoy all Mosaic benefits for one year after you spend $50,000 or more on purchases annually

with your card - Get 10% of your points back every time you redeem to use toward your next redemption

- No foreign transaction fees

- $100 statement credit after purchasing a JetBlue Getaways vacation package of $100 or more

with your JetBlue Business Card, available once every year - 50% savings on eligible inflight purchases like movies, cocktails and food

- Chip-card technology

- $0 Fraud Liability protection

- Earn 5,000 bonus points every year after your account anniversary

- Special travel and purchase protection benefits like 24/7 travel assistance and concierge

service, travel accident insurance, car rental protection, trip cancellation and interruption insurance, baggage delay insurance, purchase security, return protection, extended warranty, Global Assistance Services, identity theft helpline and more - All the benefits of the TrueBlue program: No blackout dates on JetBlue-operated flights; points in your TrueBlue account don’t expire; unlimited earning; Family Pooling of TrueBlue points

A Bit About JetBlue

Founded in 2000, JetBlue is still considered a “baby” in the airline industry. Now with 900 daily flights, JetBlue is a proven player in the industry by remaining highly-innovative and consumer-friendly with a home base at JFK’s Terminal 5 in New York.

I love that they have the idea to keep flying friendly and fun by offering free wifi, snacks, and friendly crew. And though I have never flown the “Mint” experience (their first-class product on transcontinental seats), I know it’s hands-down considered to be one of the best domestic first class products out there (including flat bed seats, high-quality on-board dining and snacks, Birchbox amenity kits…)

Their sale and PR campaigns also always tend to be brilliant (including their most recent – “Reach Across the Aisle“, where the entire flight had to work together to unanimously choose a destination for a free flight).

From a points perspective, TrueBlue points never expire, and there’s never any blackout dates. Award flights start at 1,800 points. You can earn quite a bit of points by flying (and earnings skyrocket with the credit card, as I will further explain below). But the real value is that the airline makes it easier to earn a free flight with other initiatives.

As I wrote about in the past, you can earn additional points in fun ways with “badges”. But still, my favorite perk of the TrueBlue program is the new Family Pooling feature.

Family Pooling is a unique way to earn and collect TrueBlue points with those “nearest and dearest” to you Families consist of up to 2 adults (21+) and up to 5 children (under 21). A “family†is however you define it: immediate/extended family, friends, roommates, or other points and miles fanatics. It’s up to you!

Up until recently, I haven’t put much thought into fully diving into the TrueBlue program, but let’s take a look at how one can earn points by purchasing flights:

In addition to a basic-level of earning points by booking on JetBlue.com, TrueBlue Mosaic elite members can earn even more. You can qualify for TrueBlue Mosaic by flying 30 segments plus 12,000 base flight points within a calendar year or earning 15,000 base flight points within a calendar year. You can also qualify by meeting a spend threshold on 2 out of 3 of the new co-branded credit cards.

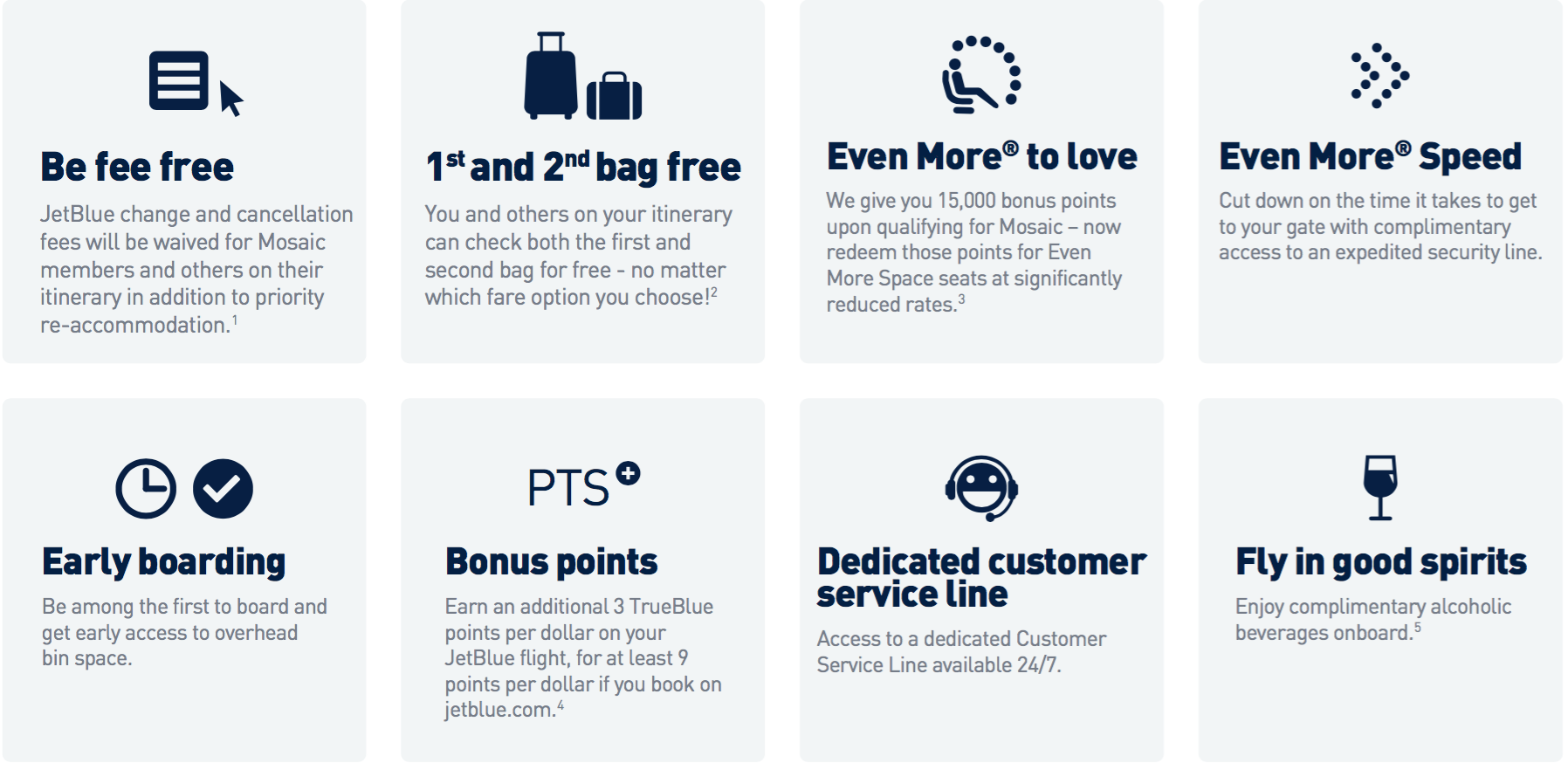

Mosaic is a pretty promising program. Here’s a glance of the benefits of Mosaic, and then I will highlight my favorites:

It’s a given that I love the free checked bag, seats with more legroom, priority access/early boarding, and earning more points (the free alcoholic drinks are nice too). What I really love is “Be fee free”. What that means is that Mosaic members are never subject to change fees or cancellation fees.

It’s a given that I love the free checked bag, seats with more legroom, priority access/early boarding, and earning more points (the free alcoholic drinks are nice too). What I really love is “Be fee free”. What that means is that Mosaic members are never subject to change fees or cancellation fees.

In the airline world, that is HUGE. This benefit (along with the free checked bag) extends to yourself and up to 3 companions on the same reservation. Essentially, you can “same-day change” by purchasing the cheapest seat for the day you want to travel and then calling at midnight on the day of travel to take the flight you really want. Sure, it may be a gamble, but if a seat is available, you can change to the desired flight without paying any fees.

Taking a Deeper Look At The Credit Card Offers:

The good news is that I find that all 3 of the cards are genuinely good products with attractive benefits. It’s nice to know that all of the cards offer no-foreign transaction fees (which you would think is a no-brainer for travel rewards credit cards) and a 50% savings in in-flight purchases.

I also want to point out that JetBlue does not have a “fixed” award chart like some of the major airlines do. Awards start at 1,800 points, and I value each JetBlue point at ~1.4 cents.

- JetBlue Card (offer expired)has no annual fee and comes with a sign-up bonus of 10,000 points (~$140). Cardmembers have the ability to earn 3x on purchases made on JetBlue.com (in addition to the 6x you’d already earn at minimum from booking on JetBlue.com as a TrueBlue member, (9x if you’re Mosaic). As an example, a $100 fare would generate 900 points for a standard TrueBlue member (~$12.60), or 1200 for Mosaic members (~$16.80). The JetBlue Card is a solid no-annual fee card.

- JetBlue Plus Card comes with a $99 annual fee, but that is almost instantly offset with the 5,000-point annual bonus (~$70). The sign-up bonus is 30,000 points (~$420) You’ll also get a free checked bag, $100 off a JetBlue getaways package of $100 or more each year, and 10% back on redeemed awards. You’ll earn 6x on JetBlue purchases, so that same $100 fare would generate 1200 points (~16.80),  when you combine this with the 6x you already earn on JetBlue.com just for being a TrueBlue member (or 1500 points for Mosaic members, ~$21). You can also earn Mosaic status if you spend $50K on the card annual (a bit much, but still an option). Overall, I think this is a killer card offer, and I’m getting it without hesitation.

- The JetBlue Plus Business Card has similar benefits to the JetBlue Plus Card, except that you can earn 2x on restaurants and office supply stores instead of restaurants and grocery stores. There are many cards already that offer 5x on office supply stores, but I can imagine true JetBlue fanatics getting both the personal and business version of the cards just for the sign-up bonus alone.

Current JetBlue American Express Cardholders: About the Conversion Cards

Last year American Express and JetBlue had a break-up, leaving many guesses about which issuer would take over the JetBlue credit card relationship. Soon after, it was announced to current JetBlue AmEX cardmembers that their cards would be replaced (as of March 21, 2016) with a Barclaycard JetBlue Rewards MasterCard.

While the $40-annual fee remained the same, The JetBlue Rewards MasterCard, will earn 4x per dollar in TrueBlue points on JetBlue purchases (compared to only 2x on the AmEx version), 2x on spend at restaurant and grocery stores, and 1x on everything else. Some other new benefits of The JetBlue Rewards MasterCard include a 5% points rebate on award-travel redemptions, no foreign transaction fees & access to MasterCard World Elite perks (concierge service, “lost luggage treatmentâ€, VIP events, etc.)

Another incentive is that cardmembers can earn a $100 companion travel discount after making $500 spend on the card by June 30.

The JetBlue Rewards MasterCard is simply the conversion product from the retired JetBlue Card from American Express.

The business version of the card got a makeover too. On March 21, 2016, current JetBlue AmEx business cardholders will be moved over to the JetBlue Business MasterCard.

The JetBlue Business MasterCard comes with a few more changes, including an increase in annual fee (from $40 to $99). On the plus side, the new card will not have any foreign transaction fees (a plus when using in JetBlue’s international cities like Barbados, Aruba, Quito and Liberia).

In addition to offering 6x in TrueBlue points per dollar spent on JetBlue; 2x at restaurants and office-supply stores; and 1x on everything else, the card features an annual bonus of 5,000 points, a 10% points rebate on all award redemptions, and a free checked bag (for you and up to 3 companions) when you use the card to book JetBlue flights.

Who Can Get These Cards?

The good news is that even if you’ve already had/have the old JetBlue American Express cards, the 3 new JetBlue Barclaycards are entirely new products, so you don’t have to worry about being subject to a “once in a life time bonus” or denied because of a “5/24” rule that another major bank has set in place.

In general, I find that Barclaycard is generous with approvals and isn’t very strict with limiting their products to existing and new customers.

Bottom Line

Barclaycard and JetBlue unveiled 3 new JetBlue credit card products and they are all a step above (and more) the old American Express products. I find amazing value in both the JetBlue Plus Card and the JetBlue Plus Business Card – so much that I am now putting a ton of energy into getting to know JetBlue on a whole new level. Now if only JFK wasn’t such a pain to get to… ;)

What are your thoughts on these new cards and the new JetBlue/Barclaycard partnership?

Angelina…can points be transferred into the JETBLUE program anymore?

As of now you can still transfer membership rewards points into JetBlue points, but I have no word on how long that will last.

Just one question… how many miles do I need for a free ticket? I know I can go to the b6 website to check, but I think the answer to my question needs to be posted for all potential new jetBlue flyers.

dh

That’s a great question! The points redemptions are variable and not fixed like AA and UA… lowest level awards are 3,500 points. Will update post to reflect that. Thanks Dan!

I was wondering if you redeem points for a flight and pay the fees with the new Jetblue credit card would that enable tou to gwt free bags? Or is it only on full purchase of flights?

Thanks and love your articles :)

Hi Beechy, yes you can receive the checked bag benefit on points redemptions as long as the fee is paid with the card. :)

One more question. I cancelled my card and hubbies Amex Jetblue on March 5th. Yesterday I received new Barclaycard Jetblue cards in mail. I read if cancelled by March 18th we would not get card and could apply for new one. Any thoughts ? Thank you for the help :)

Yes that is correct. I know several people have said goodbye to the AmEx cards as recent as a few days ago and have applied for and have been approved for the new Barclays product. Which card are you considering? I went with the Plus (personal)

I will disregard the new cards that came in the mail and go ahead and apply. I too am going to apply for the Plus (personal). Thanks for the help and I will let you know what happens.

I just submitted one of our applications and it stated they can’t process because our records show that you already have a Jetblue credit card :(

Oh wow! I would call AmEx right away and maybe even give a ring to BarclayCard too(the number on the back of the card they mailed you). They should be able to manually process your application. Maybe explain to them that you want the new product because the conversion product doesn’t appeal to you. It shouldn’t be a problem to get this squared away.

I called the number on the back of new Barclaycard and it just says call back to activate on March 21st. I will try to contact Amex.

Ugh. Amex said to call number on back of new card. Going around in circles. If you have any phone numbers to try let me know. The number they gave me was 866-749-4157. I am sure others are going to have an issue as well. Amex said they will look into it, but not sure what they can do. Thanks for listening !!

Try this number – 866 – 408 – 4064

Thank you, that phone number got me to a live person. Unfortunately she said since I had received the JetBlue bonus before we would not be eligible for the Barclays card promotion for JetBlue. I wanted to know how come we were converted even though we cancelled card. She couldnt tell me and told me to contact Amex. Sounds like we wont be eligible but it sounds like others have been successful getting promo. Any idea how?

Informative article! I’m wondering if you can start with the Plus card but change to the regular card after a year? Also, if you closed the account after a year does my FICO score take a hit?

Hi Maggie yes it’s possible to downgrade to the no annual fee version of the card after a year. If you close the account after a year, I would suggest perhaps transferring your line of credit to another Barclaycard that you currently have to avoid a hit (wont be much either way) or simply downgrade to the no fee card to preserve your line of credit. I am not a financial advisor but I’m simply sharing what I would do in your case :)

Will the business card show up in a credit report? Trying to get under the 5/24 limit, so I’d be interested in getting the business card if it’s not going to show up in my credit report.

Hi I had a question that I’m unable to find online and/or through my account- how long will it take for the card to come in the mail? I was approved/ordered the JetBlue Plus card and did not pay for expedited shipping, but don’t remember seeing how long it takes. I want to be able to keep my eye out since I’m paranoid of things like that getting stolen in the mail. Anyway, any insight is much appreciated, thanks :)

Hi Lex, new credit cards usually take about a week or so to arrive. If it doesn’t come in that time frame, you can call 866-928-3014 to see what’s up :$