I’m a fan of the SimplyCash® Plus Business Credit Card from American Express from American Express that comes with a nice sign-up bonus, no annual fee, and some great perks.

The SimplyCash® Plus Business Credit Card from American Express from American Express comes with a $250 statement credit after spending $5,000 on qualifying purchases in the first six months of card membership. Plus, earn an additional $250 statement credit after you spend an additional $10,000 or more in qualifying purchases on your Card within the first year of Card Membership. This is a great business card for people who value simplicity and who can rack up big spending in the 5% and 3% back categories.

Five Benefits of the SimplyCash Card

1. $500 in Statement Credits after Minimum Spending

A nice sign-up bonus is always a great perk that sells itself.

With this special offer, you can sign up for the SimplyCash® Plus Business Credit Card from American Express, spend $5,000 on the card in the first six months, and get a $250 statement credit, and an additional $250 statement credit after you spend an additional $10,000 or more in qualifying purchases within your first year.

For a card with no annual fee, this is a huge cash bonus.

2. 5% Cash Back Categories

Cash back is in the form of statement credits.

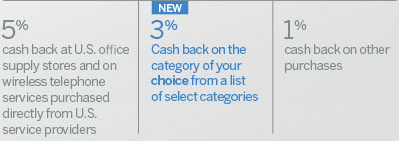

With the SimplyCash card, you get 5% cash back at US office supply stores and wireless phone providers on your first $50k annually spent in those categories.

Five percent of $50,000 would be $2,500 in statement credits a year if capped out.

This is similar to the Chase Ink cards that offer 5 Ultimate Rewards points per dollar in these exact categories. While I love Ultimate Rewards because of their ability to transfer to travel partners such as United, Hyatt, Southwest, etc., some people prefer cash back instead.

3. 3% Cash Back Categories (capped at $50,000 per rebate year)

The 3% cash back category intrigues me the most, since you can select from eight possible categories:

The 3% cash back category intrigues me the most, since you can select from eight possible categories:

- Airfare purchased from airlines

- Hotel rooms purchased from hotels

- Car rentals purchased from select car rental companies

- U.S gas stations

- U.S. restaurants

- U.S. purchases for advertising in select media

- U.S. purchases for shipping

- U.S. computer hardware, software and cloud computing purchases made directly from select providers

(For full details on what charges will code into which categories, see this page.)

When you are approved for the SimplyCash card, ask to designate your 3% back category.

The Ink Plus has a 2x category bonus on hotels and gas. Other cards have 2x or 3x categories in one or more of the categories above. But no card lets you select any of the seven categories for 3% cash back on your statement like the SimplyCash card.

4. No Annual Fee

SimplyCash® Plus Business Credit Card from American Express has no annual fee. Most of my favorite business cards have an annual fee of $95 to $450. This is great because you can “free money” by using this card during Small Business Saturday and through other AmEx statement credit offers.

One of the virtues of the SimplyCash card is that it’s very good for the lazy rewards collector. It offers good value in multiple categories, especially for a card with no annual fee.

That means that even if something becomes more pressing than keeping track of squeezing every ounce of rewards from all your cards and miles, you won’t get hit with annual fees while your mind wanders.

Who might this card be right for?

This card is best for people who don’t want to be stuck paying an annual fee, value simplicity, want to stretch their rewards further with economy travel, and who want to accrue rewards that can be used for things other than travel.

The two big benefits of the SimplyCash card are in its name.

“Simple”

Maximizing all category bonuses and mastering every mileage program takes a level of interest and effort that some people don’t want to muster. That’s fine. There are great rewards for mileage dabblers too. For dabblers, a card with an easy-to-understand rewards structure, no annual fee, and frequently-used category bonuses is ideal. That’s the kind of card the SimplyCash card is.

The only major drawback of the SimplyCash is its foreign transaction fee. Don’t use the card abroad (or even on foreign sites like britishairways.com), and don’t use the card for non-dollar-denominated transactions.

“Cash”

Cash is a better reward than miles in that cash can be used for anything and miles can only be used for a few things. You can use the cash saved from the SimplyCash’s statement credits to buy plane tickets. You can use it to pay for incidentals related to travel like airport transfers and meals. Or you can use it for any non-travel expense. Cash is more versatile than miles by a long shot.

But what miles do well, miles do really well.

Who is this card wrong for?

Don’t get this card if you collect rewards for first class travel. Cash is bad for first class travel because a first class flight can cost $10k, and a top-tier hotel might be another $1k per night.

Airline miles and hotel points put those rewards in our reach in ways that cash back cards don’t. If you are in the hobby for luxury, skip the SimplyCash card and get the Ink Plus Business Card or even the Starwood Preferred Guest® Business Credit Card from American Express.

Bottom Line

The SimplyCash card is a great business card for people who want simple, cash back rewards in customizable categories with no annual fee and a big sign up bonus. I’ve had this card for a almost 3 years, and I have no plans to let it go.

Now with the AmEx 2x Shop Small promotion, it’s opening the doors for me to be more creative in earning the most I can while dining out.

How do you use your SimplyCash® Plus Business Credit Card from American Express?

I really dont understand why anyone would apply for this over the Ink products?! $250 signup bonus after $5k isnt shit! Ink is offering $500-700 signups for the same spend and you have flexibility to transfer to partners with Ink in case you want to do that.

Im not knocking this article and like your blog just dont see ever applying for this card at this signup bonus level. Good luck with the Amex call though :) cheers!

Can you point me to a fully no fee card that offers a sign on bonus higher than $250?

I’m guessing this article was updated and that’s how a comment over 2 years old is here? Either way, I’ll give the benefit of the doubt that you’re basing this on 2014 knowledge.

One thing to keep in mind is that not everyone is interested in using points towards travel. Right now with two children under 3 years old (including a newborn) it’s just not practical nor feasible to travel. I’d rather earn cash back in the interim until it’s worthwhile to use UR towards travel. Further, for many out there like myself, I have enough UR to last a while. At some point there’s a diminished return as far as gaining value is concerned. I’d rather downgrade my INK Plus to an INK Cash and when the time is right upgrade it back to the INK Plus, pay the $95 AF, and use the points to gain 2cpp or better value.

As of right now between the 5/24 rule, $95 AF and phasing out of 5x for office supply, the simply cash plus card has definitely added a bit of luster and is a valuable tool to have. Basically $250 bonus, 5% office supply and an additional 2.5% cash back on the first $10k spend within the first year. Definitely a win in my book.

This card does not ” collect” the cash or rewards. It “simply” rebates it on your next statement, so it’s not for one who wants to save up for an award.

if you have an actual business, this card is more useful than Ink.

I see it this way – Card provides best value for spending up to first $10,000. If you manage to spend all that amount in 5% category you will be getting 10% off those purchases ( $500 (5% of $10,000) sign up bonus and additional 5% statement credit).

On the other hand with Chase INK you will earn 5x UR points on office store purchases. Again if you manage to spend that $10,000 in the office stores you ill earn 50,000UR points worth $625 (if you have Chase Sapphire Preferred) or $750 (if you have chase reserved).

Difference? $375 to $250 depending on what chase card you have