In my travel and points-obsessed family, I pay quite a bit on annual fees on premium credit cards, and I definitely find it “worth it” because of the value I’m getting year after year.

Aside from just the points, many premium credit cards, such as the Chase Sapphire Reserve, Citi Prestige, and American Express Platinum Cards, come with great travel benefits like annual airline credits, lounge access, roadside assistance, free inflight wifi, fourth-night free when booking hotels, and many other useful perks that help us save money and enhance our experience while traveling.

Many of premium cards also offer some of the best travel protection coverage benefits out there, and there’s one card in particular that I tend to favor for this reason – the Citi Prestige.

I always pay for my airfare and reserve the bulk of my trip-related expenses with my Citi Prestige just because the trip protection benefits and coverage are arguably the most generous.

Let’s also not forget how painless the process is when filing claims. I had a wonderful experience with a previous claim when my stroller became lost and damaged on trip last year.

But while I was planning my two and a half week trip to South East Asia with my kids earlier this year, I asked myself: ‘is credit card protection really enough?’

Credit Card Insurance vs. Travel Insurance

Prior to taking the trip, I decided it was best to get a stand-alone travel insurance policy to cover all grounds. Travel insurance is something you want to have but hope to never have to use.

Most travelers, especially those in the miles and points hobby (myself included), don’t think about purchasing a stand-alone travel insurance plan because often times we believe we already have coverage with our credit cards.

Credit cards do have coverage, but to an extent.

Many of our favorite rewards credit cards offer emergency medical evacuation, but do not offer medical-related coverage, like a hospital stay or a trip to the emergency room.

If God-forbid you or someone in your family becomes injured or sick abroad and needs medical care, the credit card protection might extend assistance in arranging care, but they do not automatically reimburse for medical expenses.

One example that always stuck in my mind was when a fellow blogger and friend of mine, Dia, shared that a $38 travel insurance policy saved her from spending $5,000 on a hospital bill when her husband injured himself on a trip to the Gran Canaria islands.

And another thing to consider – if you’re using miles and points to make your travel bookings, you’re not essentially “paying for the reservation”; therefore, you may be not be guaranteed coverage.

Both the Citi Prestige and American Express Platinum will help you in an evacuation, but will not help you with medical bills overseas.

Another point to consider is that coverage with the Chase Sapphire Reserve is supplemental ($2,500 for medical and $100,000 for evacuation) in the event of a medical emergency while traveling abroad, meaning they will only pay after your standard health insurance company processes the claim.

Most standard health insurance policies do offer some level of coverage when you travel, but it’s a matter of how much, how quickly, and how frustrating of a process it may be.

Travel insurance is intended for those who wish to feel protected from unplanned inconveniences to calamities while traveling by and electing coverage with financial safeguards.

Coverage can range from costs incurred before the trip takes place, such as nonrefundable airfare or hotel stays, to unexpected costs that come up during the trip, such as travel interruptions and unexpected medical expenses.

It’s also worth noting that a stand-alone travel insurance policy is primary and you don’t have to deal with copays or hassles, and the policy will cover both evacuation and medical claims.

Our Asia trip was fun, but also fast-paced with many moving parts, and luckily the only hiccup we encountered was when I managed to lose something of value in several countries. Thankfully no one got sick or injured along the way, and there weren’t any catastrophes.

Annual vs. Trip-Only Plans

When purchasing travel insurance, you’re presented with the option to buy coverage on an annual or per-trip basis.

Since my family travels several times a month, an annual plan makes sense for us. It’s nice to get coverage for an entire year and not have to worry about buying a new policy for every trip. With annual plans, existing conditions would be covered since insurance would already be in place.

For those who travel less frequently, there is also an option of trip-only plans can range to from $29-$99, depending on the amount of people traveling and cost of trip. Kids 17 and under are covered for free when traveling with a parent or grandparent.

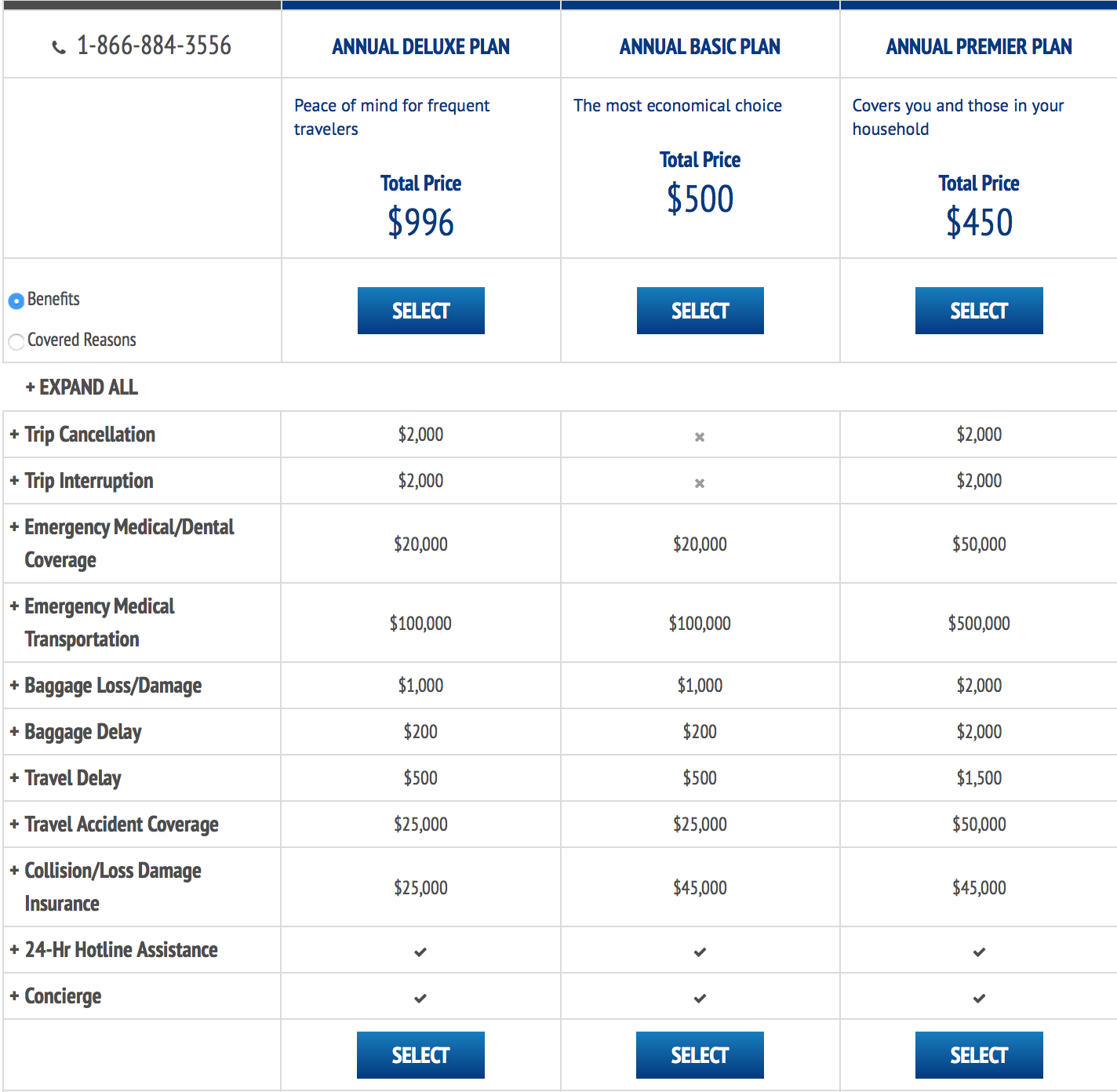

With Allianz, the Annual Premier Plan starts at $450/year and covers everyone in a household up to and including grandparents (whether traveling separately or together), along with trip cancellation/interruption protection, up to $15,000 per year. There’s also coverage for financial default instances, like if a tour or travel provider goes out of business before or during your trip).

It’s a great option for families like mine that enjoy multi-generational travel.

If a travel insurance policy makes sense for your family, you can get a free and instant from quote from Allianz here simply by entering the ages of everyone in your household and intended dates of travel.

My policy also includes a 24-hour assistance and concierge (while this doesn’t come with a dollar amount, getting real-time help when you’re in a crisis is invaluable, especially if you need help in a place where you don’t speak the native language).

Bottom Line

While I certainly love the travel protection my premium credit cards offer, I no longer solely rely on them to protect my family during unfortunate circumstances, especially because I travel near and far with my young kids (by the way, a “trip” is defined as 100 miles from home).

It’s important to thoroughly read the fine print and understand exactly what coverage your credit cards may come with by calling the number on the back of your card or referring to the benefits guide.

Let’s be honest – kids fall, siblings fight, and sometimes we are all just sleep-deprived and clumsy.

Accidents can and will happen, and you can’t predict a sickness. Having the peace of mind to truly enjoy your time away is money well spent.

Have you ever purchased a travel insurance policy before? Do you have any stories worth sharing?

Disclaimer: I work as an ambassador for Allianz Global Assistance (AGA Service Company) and receive financial compensation.

The best places to get travel insurance from are SquareMouth.com and InsureMyTrip.com because you can compare prices and coverage options from multiple insurance companies.

Yes, it’s always great to compare policies and shop around. Aside from just the price of the policy and benefits, it’s also important to research which companies are ranked and reviewed as having the best reputation in handling claims. Allianz is ranked #1 out of 22 polices as best travel insurance for long trips, so I am confident in recommending them.

Coverage included with cards can get very tricky.

I am never sure what is included in medical evacuation, whether it includes transport home or to the closest city that can provide care.

Not sure what is covered on the policies above that does not come with a premium credit card. Also, medical expenses abroad are covered by the “out of network” medical policy most people have in the US. I needed to go to the doctor couple times while traveling abroad, paid cash, got a receipt and when back to the US submitted a claim and got reimbursed by my medical insurance plan.

Hi Santastico, thanks for stopping by!

Different credit cards have different travel benefits. It’s important to review your credit card coverage and decide if you need travel insurance. For example, credit cards may not cover emergency medical transportation. An evacuation by air ambulance can cost you tens of thousands of dollars. The right travel insurance policy will arrange and pay for this. While your health insurance may cover you for medical emergencies abroad, if you are hospitalized you may be asked to pay thousands or tens of thousands of dollars before you leave the hospital. A travel insurance policy will guarantee payments to the hospital so that you don’t have to pay anything out of pocket. All of this coverage can cost as little as $30, which is well worth it in my opinion.

I always get Allianz insurance for our trips if they are international and/or expensive. I usually just get the most basic policy up to about $5k. I’ve never paid more than $78 for a policy. And I’ve cashed in on some medical bills with them. Easy peasy. I also have Citi Prestige and CSR, but I like the full coverage and comfort.

what about if I paid miles for my trip? all or part, how will i price it?

Hi Maria,

Unfortunately it’s not possible to assign a monetary value to miles. If someone used miles to book a trip and then wants to buy insurance six months later (this is a bad idea by the way, you should always purchase insurance when you book your trip so that you get the longest period of coverage possible) the insurance will cover the cost to redeposit the miles into your frequent flyer account. That goes for annual plans too that have cancellation coverage. Most airlines charge $150 per person to redeposit miles. You’d still receive the same medical coverage and benefits once you’re on the trip whether you’ve paid with the miles or cash. Hope that helps!

Hi Angelina

Just wanted to let your readers know to read the fine print/exclusions of the Allianz (and any other medical travel insurance policy!) very closely! I was DENIED by Allianz in 2014 because I was injured and had ongoing medical bills due to an activity (zip-lining) that was actually NOT COVERED. I had to seek treatment when I was back in the USA en-route but not in my hometown and while my MEDICAL was covered by my personal health insurance, I was not able to claim hotels, and loss of air travel, etc.

Adventure activities are probably not insurable anywhere – but check your policy to see what is determined as “high-risk” fun!

justjulesrtw

$20,000 emergency medical coverage? That’s about one hour in a USA hospital. I guess it depends where in the world you require the emergency care. As Canadians we generally buy travel insurance policy with a $5 million dollar limit. (Covers about 2 days in a Florida hospital).