The brand new Marriott Rewards Premier Plus Credit Card (Learn More) is finally available today and it has all of us curious – especially since it comes with very a generous sign-up bonus of 100,000 Marriott Rewards points after spending $5,000 on the card within the first three months of account opening. The older Marriott Rewards® Premier Credit Card has been a staple hotel credit card in my wallet for many years, and I find it worth it to pay the annual fee just for the yearly free night certificate.

The older Marriott Rewards® Premier Credit Card has been a staple hotel credit card in my wallet for many years, and I find it worth it to pay the annual fee just for the yearly free night certificate.

The Marriott Rewards Premier Plus Credit Card (Learn More) is definitely an upgraded version for most of us. Even with a $10 increase in annual fee, there are many improvements to the card benefits.

In addition to the 100K sign-up bonus, the new card offers:

- Free Night Award (valued up to 35,000 points) every year after account anniversary.

- Earn 6 points per $1 spent at participating Marriott Rewards & SPG hotels.

- 2 points for every $1 spent on all other purchases.

- Automatic Silver Elite Status each account anniversary year.

- Path to Gold Status when you spend $35,000 on purchases each account year.

- Coming in 2019, 15 Elite Night Credits each calendar year.

- Earn unlimited Marriott Rewards points and get Free Night Stays faster.

Keep in mind that existing Marriott Rewards Premier credit card holders are not eligible to receive the 100,000 point welcome bonus, and card holders are also ineligible if they’ve received a welcome bonus on any personal Marriott Rewards credit card in the past 24 months. All personal Marriott Rewards credit cards are also subject to Chase 5/24.

What Existing Marriott Rewards Visa Cardmembers Need to Know

Existing Marriott Rewards Visa card members have the option to product swap to the Marriott Rewards Premier Plus Credit Card (Learn More).

If you’re like me and already have the Marriott Rewards Premier credit card, you can check to see if your account is targeted to receive bonus points as an incentive to upgrade to the Premier Plus.

Offers are ranging from 10,000-50,000 points. Out of curiosity, I plugged in my info and saw that I was targeted to earn 20,000 bonus Marriott points by upgrading and making a purchase on the new card by 12/31/18.

At first glance, 20,000 bonus Marriott points for a $10 increase in annual fee is definitely “worth it”. Afterall, Marriott points transfer into Starpoints at a 3:1 ratio, so that’s 6,667 Starpoints, which I value at over $140.

Even with the bonus points, I can see why some might be hesitant to jump ship, especially if you’ve been a Marriott card holder for a long time.

If you’re not impressed with your upgrade offer, you could always cancel the existing card and apply for the new one just as long as it’s been at least 24 months since you received a welcome bonus on a Marriott personal Chase card.

Since you cannot have both cards at the same time, it may make sense to submit a new application shortly after closing the existing account, so that you can receive the full 100,000 sign-up bonus.

Also another consideration to keep in mind is that completing this product change may result in a change to the month you receive your annual free night certificate.

I recently received [and redeemed] my yearly free night in February, so I’m really in no hurry to product change just yet.

Comparing the Two Cards

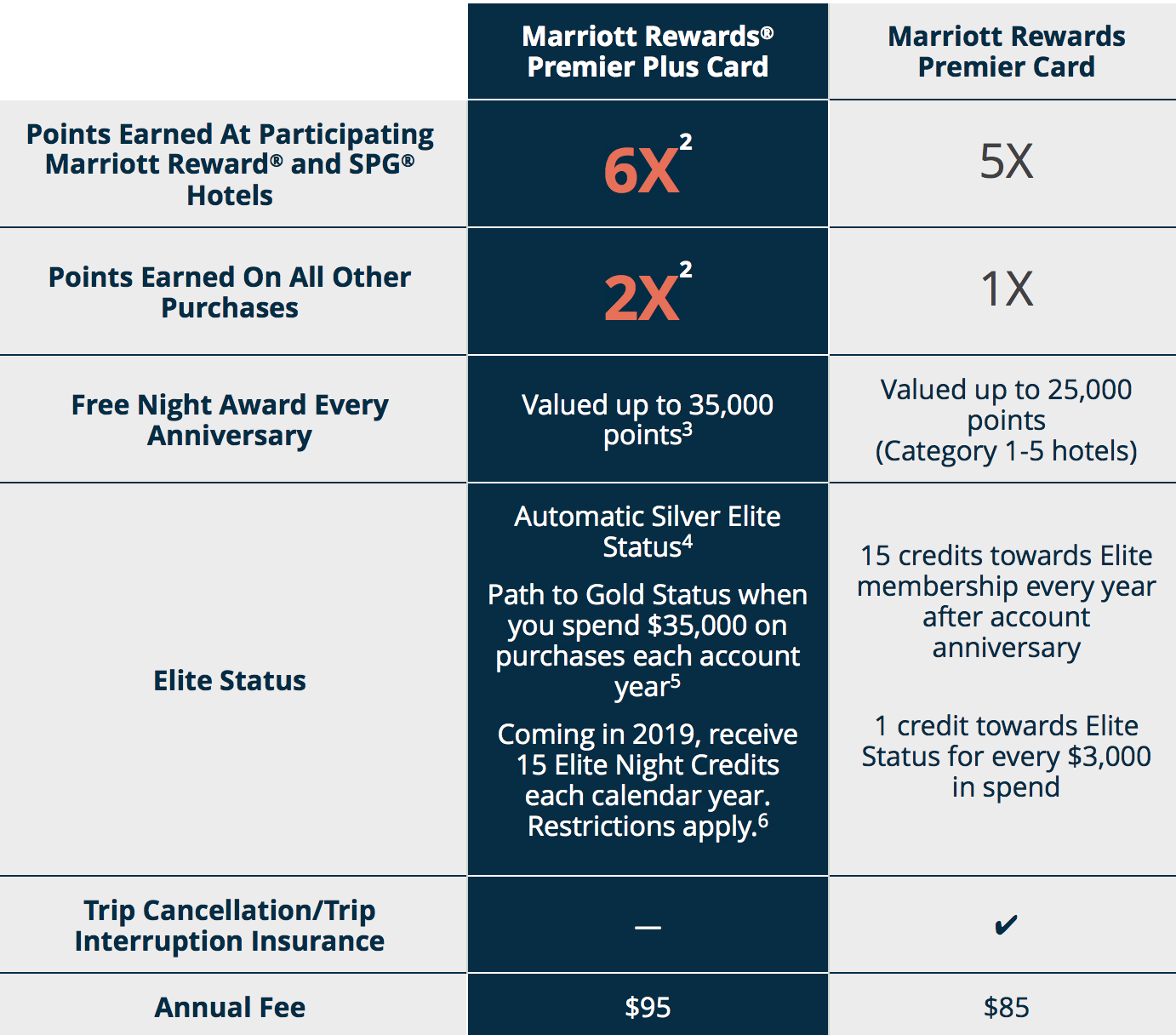

We already know that the annual fee on the Premier Plus credit card is $10 higher than than the Premier, but there are other changes to consider too.

Here’s a side-by-side comparison of what the two products look like next to each other:

Some of the new benefits that jump right out is the improved free night certificate and increase in earnings potential (from bad to not as horrible) when spending on the card.

In fact, last month, I shared my reasoning behind why I don’t even use my Marriott credit card at Marriott properties.

The Marriott Rewards Premier card comes with a free night certificate at category 1-5 hotels, whereas the Premier Plus comes with a free night certificate good for properties up to 35,000 points, which can be very valuable between August 1 and December 31 of this year.

Though this probably won’t impact many, there are also some changes to the way one can earn elite status credits. With the Premier card (old), you have the ability to earn 1 elite night credit with every 3,000 in spend. For the Premier Plus (new), the 15 elite night credits will only kick in starting in 2019.

It’s also worth noting a card benefit “downgrade” with the removal of trip interruption/cancellation insurance on the Premier Plus. Chase seems to be removing this benefit from many of their products across the board.

Of course, I am not too bothered by the loss of this benefit since I use other cards like the Citi Prestige for travel insurance coverage.

Things to do with 100,000 Marriott Points

100,000 Marriott points is a very generous offer. Before the March devaluation, I redeemed exactly 100,000 Marriott points for 5 nights at the JW Marriott Phu Quoc, where the nighty rates were over $500.

I also spend just 40,000 Marriott points per night for an amazing stay at the brand new Ritz Carlton Langkawi.

Not only are there some amazing hotel properties worldwide where you can redeem Marriott points for, let’s not forget that there are other out-of-the-box ways to use this sign-up bonus.

Marriott Reward points can still be transferred into SPG points at a 3:1 ratio until the August 1, when Starwood and Marriott will combine with the new program.

100,000 Marriott points = 33,333 Starwood Preferred Guest points.

You can transfer 20,000 Starpoints into 25,000 airline miles of your choosing (across almost 40 different programs).

What’s also exciting is that the new Marriott award chart offers some amazing value and “sweet spots” between August 1 and the end of the year. My strategy is to stock up on as many Marriott and Starpoint points as I can before that time.

Just one example: The W and St Regis in Bali will cost 30,000 points less per night if booked after August 1.

Bottom Line

The new Marriott Rewards Premier Plus Credit Card (Learn More) sure is enticing, and it’s definitely on my radar. Since I am well under 5/24 and I’ve had the card for many years, I am thinking about closing my existing card and then applying for the new product instead of jumping on the opportunity to upgrade right away.

What is your plan?

LEARN MORE about the Marriott Rewards Premier Plus Credit Card

Leave a Reply