For a while, I’ve steered away from applying for new credit cards because of Chase 5/24, but with the relaunch of the American Express® Gold Card in October, it was hard for me to resist, partially due to FOMO and admittedly because I was instantly drawn to the limited-edition rose gold color, which is only available until January 9, 2019.

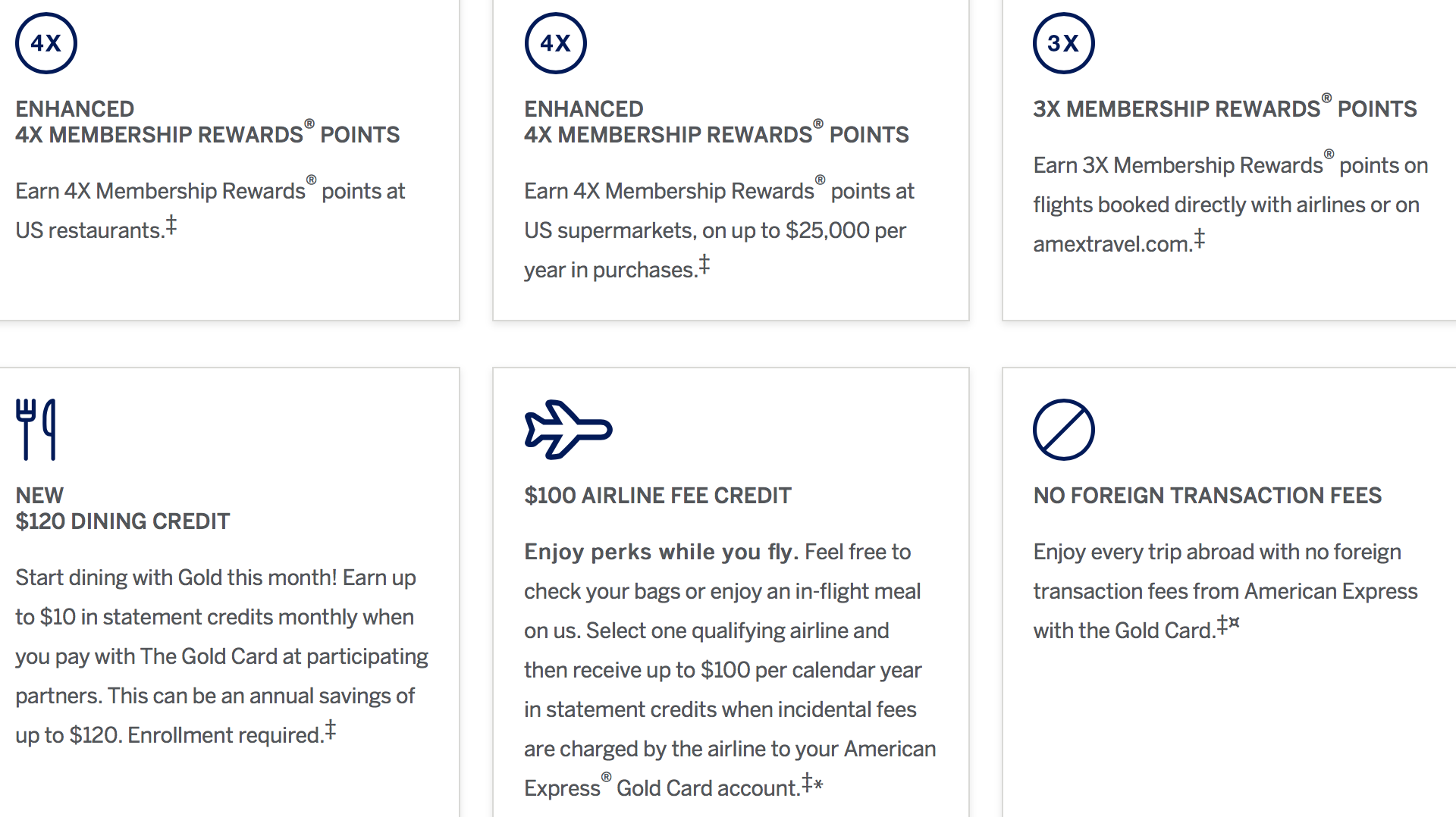

Card Benefits

Aesthetics aside, the card comes with really compelling benefits, and since I have never had the Premier Rewards Gold Card previously, I knew I’d be eligible for the welcome bonus (it’s double when you apply through a friend’s referral link, see below).

The new refreshed Gold Card earns:

- 4x points per dollar spent at US restaurants and grocery stores (up to $25,000 per year)

- 3x points on flights booked directly with the airline

- 1x point on everything else.

Additionally, there’s the ability to earn up to $120 each year in dining credits ($10 per month), and the existing $100 annual airline fee credit per calendar year still remains the same.

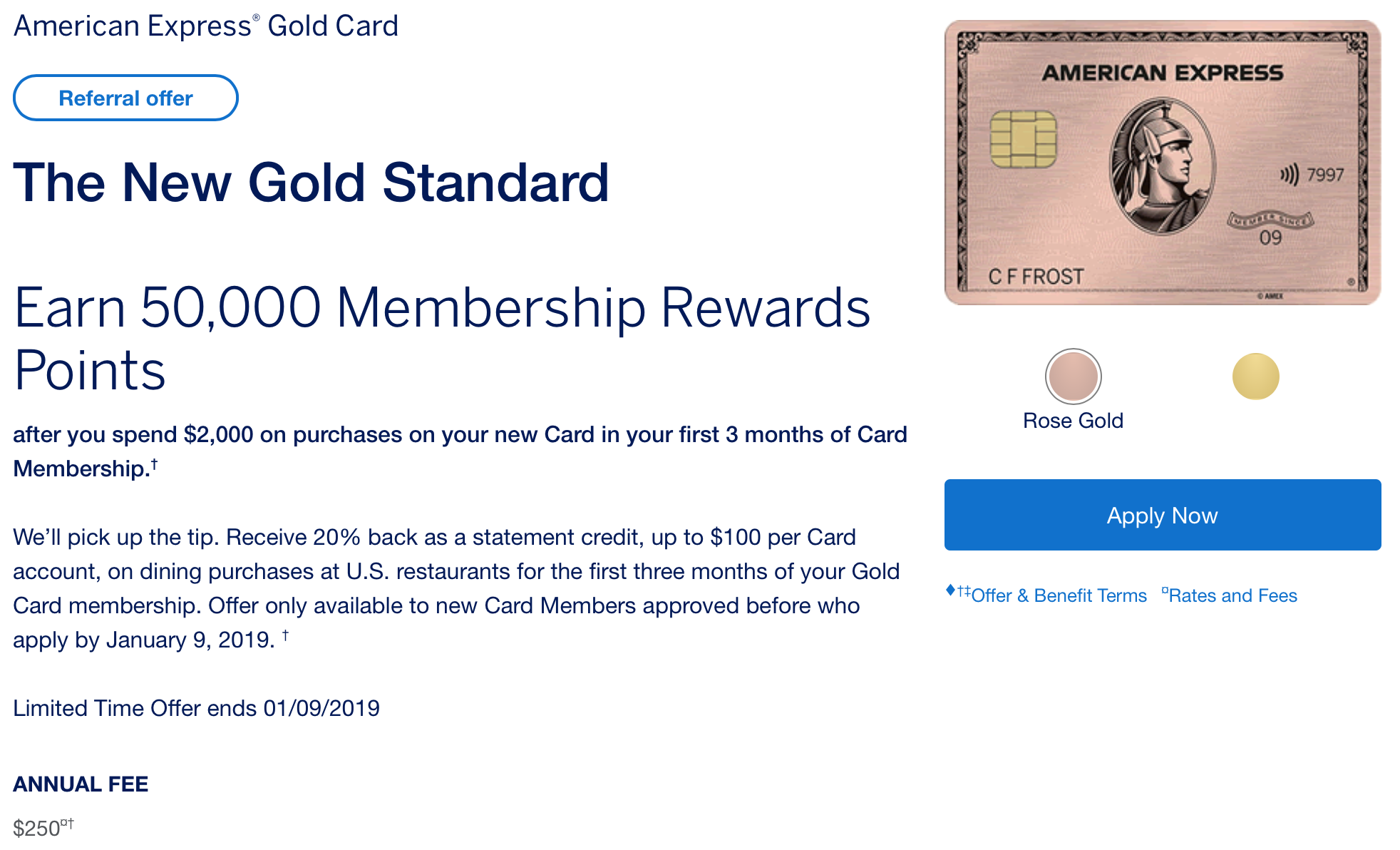

Enticing Welcome Bonus until January 9

As with all American Express products, the welcome bonus is only available to new cardmembers who have not previously had the Premier Rewards Gold, as the new AmEx Gold Card is replacing the PRG entirely.

Until January 9, the public sign-up offer is:

- Receive 20% back as a statement credit at U.S. Restaurants with the Gold Card within the first 3 months of your Card Membership, up to $100 back.

- 25,000 Membership Rewards® Points after you spend $2,000 on eligible purchases with your new card within the first 3 months

The $250 annual fee is not waived.

However, there’s an even better 50,000 point offer if you apply for the card through another card member’s referral link:

Applying in December

Aside from my instant attraction to the rose gold metal card, I also didn’t want to skip out on earning $100 back in the form of 20% rebates, which is a perk only available to applications received before January 9.

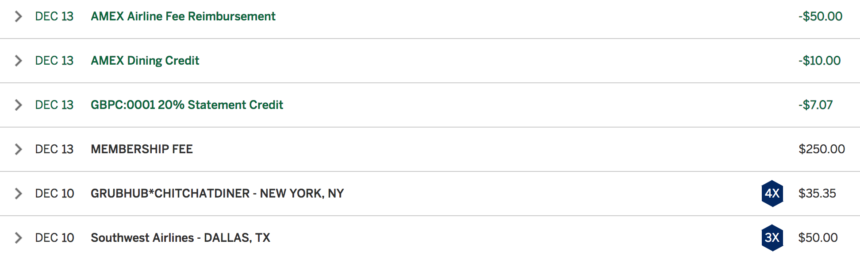

I knew I wanted to pull the trigger before January 9, but applying before 2018 comes to an end also opens the door for me to receive an additional $100 airline credit, which was enough of a push for me to apply immediately.

Immediately upon receiving the card, I purchased two $50 Southwest e-gift cards to activate the airline fee credit right away. Historically, I used to use my AmEx airline fee credits to make deposits into my United Travel Bank, but that service has been down for over a year, so it was time to make a switch.

As you can see, the statement credits for the airline credits, the dining credits, and the 20% dining rebates started to come in quickly:

Overall, I’ve paid $250 upfront for the annual fee, but I will receive the following before my next annual fee is due in December 2019:

- $100 in airline fee credit for 2018 (December)

- $100 in airline free credit for 2019 (January)

- $100 total in 20% dining rebates

- $120 in dining credits (in monthly increments of $10)

- A welcome bonus of 50,000 Membership Rewards points (which I value at a minimum of $750)

Quite frankly, I consider the AmEx Gold Card to be the highest-earning card for dining rewards and grocery spend currently on the market. At minimum, I value Membership Rewards points at 1.5 cents each. With that in mind, it’s like getting a whooping 6% return at baseline.

Although the $250 annual fee is not waived, the card’s benefits and earnings ability outweighs the cost. Aside from the generous sign-up bonus of 50,000 Membership Rewards points with an easy spending threshold, utilizing the $100 airline credit now in December for 2018 (and again in January for 2019), the 20% back on restaurant purchases in the first 3 months (up to $100) and $120 dining credit makes this card a tremendous money-maker long before the next annual fee is due.

There’s still more than enough time for you to apply for this card to replicate my strategy before the end of the year.

Who else has gotten the AmEx Gold Card in 2018?

I agree that it’s a great card, but some of the benefits don’t appeal to me. I like the 4 points for restaurants, but their extra $120 dining bonus is for certain restaurants only and, frankly, I think they suck.

What I find valuable are the travel benefits including the $100 reimbursement for certain charges. I find Membership Rewards Points to be valuable. I find American Express not a pain in the neck to deal with. I can get at least $100 in value every year from their special offers. So, basically, I’m out $50 per year on the annual fee. Since it’s been on my credit reports 27 years already, I might as well continue with it.

Hello, I had a question.

If I got the card on January 9th. Would i still be able to double dip in the credits? Will I be able to use credits for the rest of 2019 and then again in 2020 before January 9th?