A new and competitive no-annual fee 5x card from a smaller issuer, Amalgamated Bank of Chicago, was quietly revamped and introduced at the beginning of the year. While I haven’t applied for this card myself because I’m holding off on new cards until I’m under 5/24, the new ABOC Platinum Rewards MasterCard is certainly worth talking about because it’s a strong competitor to other 5x cards that many of us have and love such as the Chase Freedom, Citi Dividend, and Discover it. You can learn more about and compare cash back cards here.

The ABOC Platinum Rewards MasterCard features a sign-up bonus of a $150 after spending $1,200 on the card within the first 90 days of account opening. The most compelling feature of the card is that it allows you to earn 5x rewards on up to $1,500 in combined purchases each quarter in popular categories such as dining, groceries, travel, and automotive.

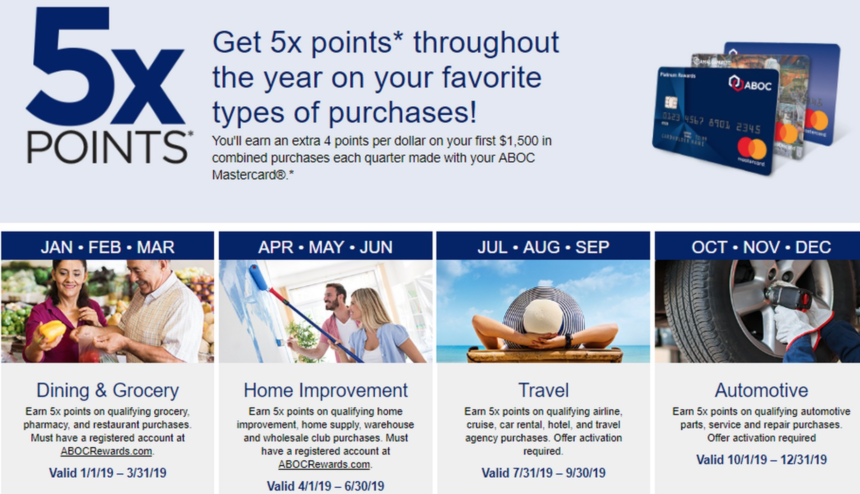

Quarterly Rotating Categories

The 5x bonus categories for 2019 are:

- January – March: Dining, Grocery, and Pharmacy

- April – June: Home Improvement & Wholesale/Warehouse Clubs

- July – September: Travel (airline, cruise, car rental, hotel, and travel agency purchases)

- October – December: Automotive parts, service, and repair purchases

Points can be redeemed for travel, gift cards, merchandise, and statement credits.

- When redeeming for travel (cruises and airfare), it’s 1 cent per point through their portal

- You can redeem for gift cards at .77-.93 cents per point, depending on the merchant and denomination

- Lastly, you can cash out your points for a statement credit on your account at .75 cents per point

Obviously with that laid out, you’ll get the most value of your earned points when you redeem them for travel.

In my humble opinion, the the first half of 2019 has great 5x categories. The quarter 3 category doesn’t quite resonate with me because I personally use my Citi Prestige card year-round for 5x and 3x ThankYou points on airfare and hotel purchases, respectively (which transfer 1:1 to a number of airline and hotel partners for maximum value); however, the fourth quarter 5x bonus category for automotive parts, service, and repair purchases is interesting because no other card has ever offered 5x on auto-related purchases- inevitable expenses that can add up (oil changes, wipers, car washes, brakes, tires, etc.), so why not maximize those expenses?

Yes, some might argue that you can use your Chase Ink Business Cash and/or Chase Ink Business Preferred to purchase Visa/MasterCard gift cards at office supply stores (when fee-free gift card promotions surface from time-to-time) as a way to earn 5x on everyday purchases, but after discovering that my prepaid MasterCard gift card was hacked before I even took it out of the packaging, I’m personally turned off by the risks that come with purchasing gift cards to use at a later date.

Bottom Line

I’ll be honest – while I usually prefer earning flexible points where I can transfer directly into airline and hotel partner programs (such as Chase Ultimate Rewards and AmEx Membership Rewards) vs redeeming them for statement credits to offset charges, the ABOC Platinum Rewards MasterCard piqued my interest for two reasons: 1. it has a $0 annual fee, and 2. the fourth quarter 5X category is interesting and unique to what has been offered previously by any bank.

I personally think the Chase Freedom takes the throne for the best rotating category 5x card because of the ability to transfer the 5x in “cash back” into Ultimate Rewards points that are transferable to travel partners when paired with a premium Chase Ultimate Rewards card (such as the Chase Sapphire Preferred). On the other hand, if you’re way over 5/24 and the Chase Freedom is not an option for you, but are still looking to add a 5x card to your wallet, the ABOC Platinum Rewards MasterCard is a strong candidate to consider.

Keep in mind that all other non-5x categories earn 1 point for every $1 spent, so I wouldn’t recommend this card for regular non bonus spend since there are many other cards that offer better rewards such as here are plenty of no-annual fee cards that may offer more than 1x back on everyday purchases such as the Chase Freedom Unlimited (1.5x) and The Blue Businessâ„ Plus Credit Card from American Express (2x on up to $50,000 spend annually, learn more).

What are your thoughts about the new ABOC Platinum Rewards MasterCard? Have you applied already?

The 5x bonus categories don’t include Sam’s Club purchases, but do include Costco and Walmart Supercenters. WHY????