Earlier this week, American Airlines dropped the bomb that we all knew was coming – details about the way customers can earn miles from flying & introducing a spend requirement to reach elite status. In short, they’ve joined United & Delta in going “revenue-based”, but the changes are worse than I’d imagine them to be (one example upgrade priority based on price of ticket rather than elite status), and the changes come with very little notice (new earnings model kicks in August 1, 2016 & spend requirement for status is effective on January 1, 2017).

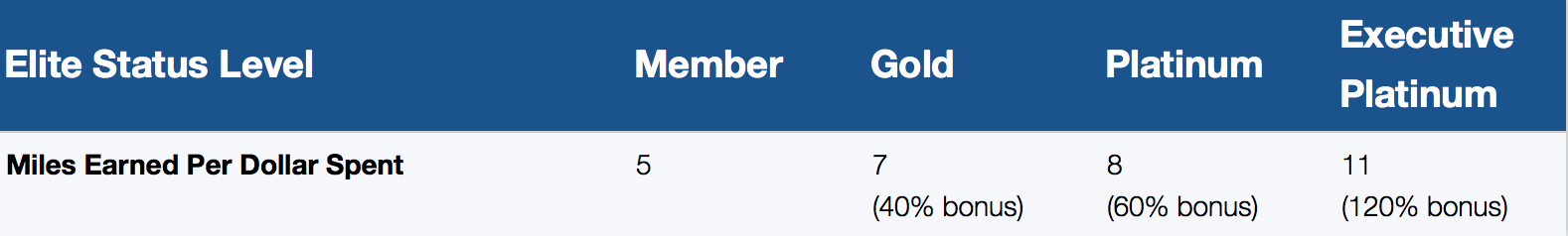

Under the new earnings model, the average flyer, without status, will earn 5 miles per dollar spend (excluding taxes and fees), and with so much competition out there (JetBlue, Southwest, etc.), most casual fliers are choosing a lower price over loyalty (myself included). Once the new requirements take effect, it’s not going to be easy for most to rack-up “butt-in-seat” redeemable miles.

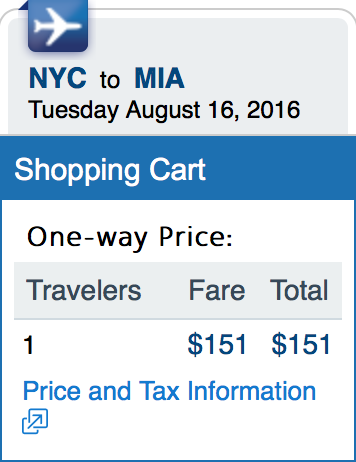

Here’s a glance of the new way customers will earn American miles:

For visualization purposes, lets look at a sample EWR to MIA fare of $151.

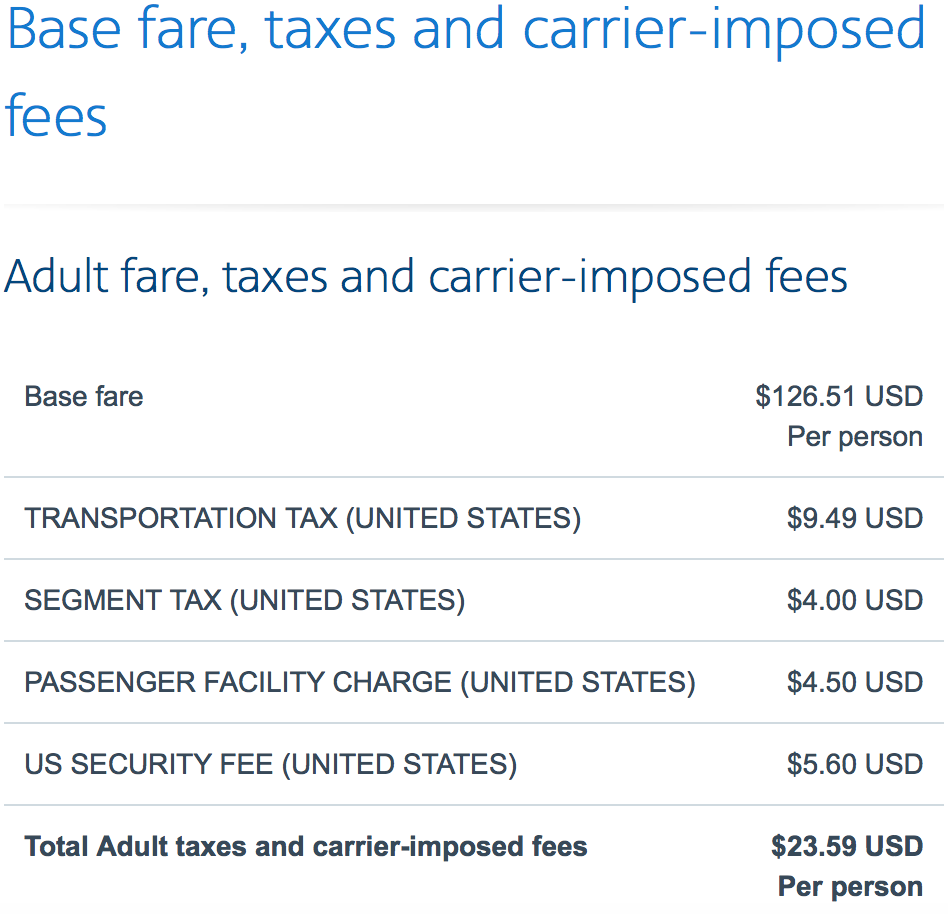

Looking at the breakdown of price, only $126 of the fare is eligible to receive 5 miles per dollar spent (630 miles). Before August 1, 2016, one could earn 1,085 base miles for taking the flight based on distance traveled.

Looking at the breakdown of price, only $126 of the fare is eligible to receive 5 miles per dollar spent (630 miles). Before August 1, 2016, one could earn 1,085 base miles for taking the flight based on distance traveled.

While $151 from New York to Miami is not what I would call an amazing deal (in fact it’s more than I would pay – this is a case where I would use Avios), just imagine how little miles you’d earn during a fare sale (I often see $50-$70 American Airlines fares between New York and Florida).

Perhaps you take that sample $151 fare and fly between New York and Los Angeles. Normally you’d pocket 2,475 base miles on a distance-based model, but after August 1, you’d earning merely 630, 75% less!

With that being said, it’s safe to say I probably won’t be putting energy into earning status next year with the new spending requirement in place, and that I’ll be focusing on other ways to earn miles without actually flying.

American Airlines Co-Branded Credit Cards

Earning AAdvantage miles through credit cards just became more valuable, and there a number of co-branded Advantage cards out there for everyday spend. I personally have the Citi AAdvantage Platinum Select Visa, and I found that it’s been worth it to keep it open (10% back on redeemable miles is my favorite perk, so at minimum, it’s earning 1.1x per dollar in my eyes).

Transfer Starpoints

One of the most lucrative options is transferring Starwood points from the Starwood Preferred Guest® Credit Card from American Express and Starwood Preferred Guest® Business Credit Card from American Express.

Starpoints transfer to AAdvantage miles at a 1:1 ratio; and for every 20,000 points transferred you’ll get 5,000 bonus miles. 20,000 Starpoints = 25,000 American miles. Last year there was an amazing transfer bonus promotion where 20,000 Starpoints converted into 30,000 American miles!

RocketMiles

RocketMiles is a 3rd party hotel booking site that allows you to earn miles on hotel stays. While it’s not always the best value price wise to book a hotel through them, it’s worth noting that right now they’re running a promotion to earn 3,000 bonus American Airlines miles after your first booking (on top of the usual earnings, starting at 1,000).

An example rate I saw was $89 per night at the Luxor in Las Vegas (obviously not the lowest rate) & it would generate 4,000 American Airlines miles (substantially better than earnings on an $89 American Airlines flight after August 1!).

If you don’t have a RocketMiles account yet, sign up with my link for 1,000 bonus miles just for joining when you make your first booking.

AAdvantage Dining Program

A “back to the basis” way to earn miles, but actually might be more lucrative than earning miles on flights after August 1. Be sure to join the American Airlines Dining Program to get points when you dine at select restaurants and then complete a survey shortly after.

Right now you can get 1,000 bonus Advantage miles by spending $30 with your enrolled credit card at a participating restaurant within 30 days of joining (in addition to earning up to 5x per dollar spent, including tax and tip)!

Online Shopping Portals

Of course you should always shop through a shopping portal to earn cash back and miles on purchases made online. At 9x per dollar, a $100 purchase at 1-800-FLOWERS through the AAdvantage shopping portal will get you more miles (and make someone’s day) than a $100 American flight after August 1.

You can also earn 1,300 miles at 23andme.com if you’re interested in your genetic DNA ancestry profile (has anyone done it?).

Car Rentals

You can earn between 500-1,250 miles per car rental depending on your elite status/co-branded credit card holder with Avis and Budget. For some, even a car rental would net more miles than a cheap flight.

Bottom Line

Since American Airlines is currently not a transfer partner with Chase Ultimate Rewards, American Express Membership Rewards, or Citi Thank You Points, and the ability to earn miles by flying will soon drastically decrease, I’m sure many people will be shifting their focus away from the program. If you’re really set on earning American miles, going “back to the basics” and earning them through other means might be your best bet.

What other alternative ways can you suggest to earn miles that ends up being a better value than actually flying?

Of course, it’s important to distinguish between award miles and bonus miles. While many of these good ideas will earn you bonus miles, they don’t count towards any status level.

I can’t remember the last time I paid for an AA (or partner) flight. I’ve only accumulated points via credit cards for the last 20 or so years and plan to continue as long as it’s an option.

you say transfer starpoints…but then say how AAdvantage is not a xfer partner? i’m confused (and a relative newbie!)