I just got back from a great week-long trip in Stockholm. While I am not one to plan trips solely around shopping, I was on the prowl for a specific high-end purse. In short, I was gifted a really nice Chanel as an anniversary gift the day before my departure. The sad news what that I couldn’t bring the purse with me on the trip because I opted to ship it to NY to save 7% on NJ state taxes (we’re talking over $250), but I knew there might be a way to do better. Since I am known for returning gifts and re-buying them to get points, it wasn’t too far out of my element to see if I can save some money when there’s an opportunity. Was it really possible to purchase the exact same purse at a substantial discount with a VAT refund?

Since I am known for returning gifts and re-buying them to get points, it wasn’t too far out of my element to see if I can save some money when there’s an opportunity. Was it really possible to purchase the exact same purse at a substantial discount with a VAT refund?

The bad news is that I couldn’t find the purse, but the good news is that I had my first experience with VAT refunds thanks to many hours of walking (aka blisters) and Sweden’s fickle weather. My purse shopping turned into me buying sweaters in July and a few pairs of comfortable walking shoes because the heels I packed showed me who was boss.

I’ve always heard about VAT refunds, but I’ve never paid much attention to detail because as I mentioned before, I don’t really shop much while traveling. But for frequent travelers who purchase things abroad (besides meals and hotel rooms), you’re probably leaving money on the table without even knowing if you’ve never claimed a VAT refund at the airport.

VAT stands for “value added tax†which is already included in the price of goods; if you reside outside of Europe, you’re entitled to getting that back.

The Details and “Fine Print”

VAT refunds can be up to 25% depending on the purchase price and country of purchase. Here’s a helpful guide to see what your refund rate would be.

You have to reside outside of Europe, and the address on your Passport, or other accepted forms of identity, must prove this in order for you to receive a VAT refund. It’s also worth noting that not all shops in Europe participate, so be sure to ask ahead to time or at the time of your transaction. In my experience, I simply asked for a VAT refund slip after I paid.

If you’re on an extended-trip, take note of when you buy your items because you are not eligible for the VAT refund if you do not leave within three months of your purchase.

How You Can Get a VAT Refund

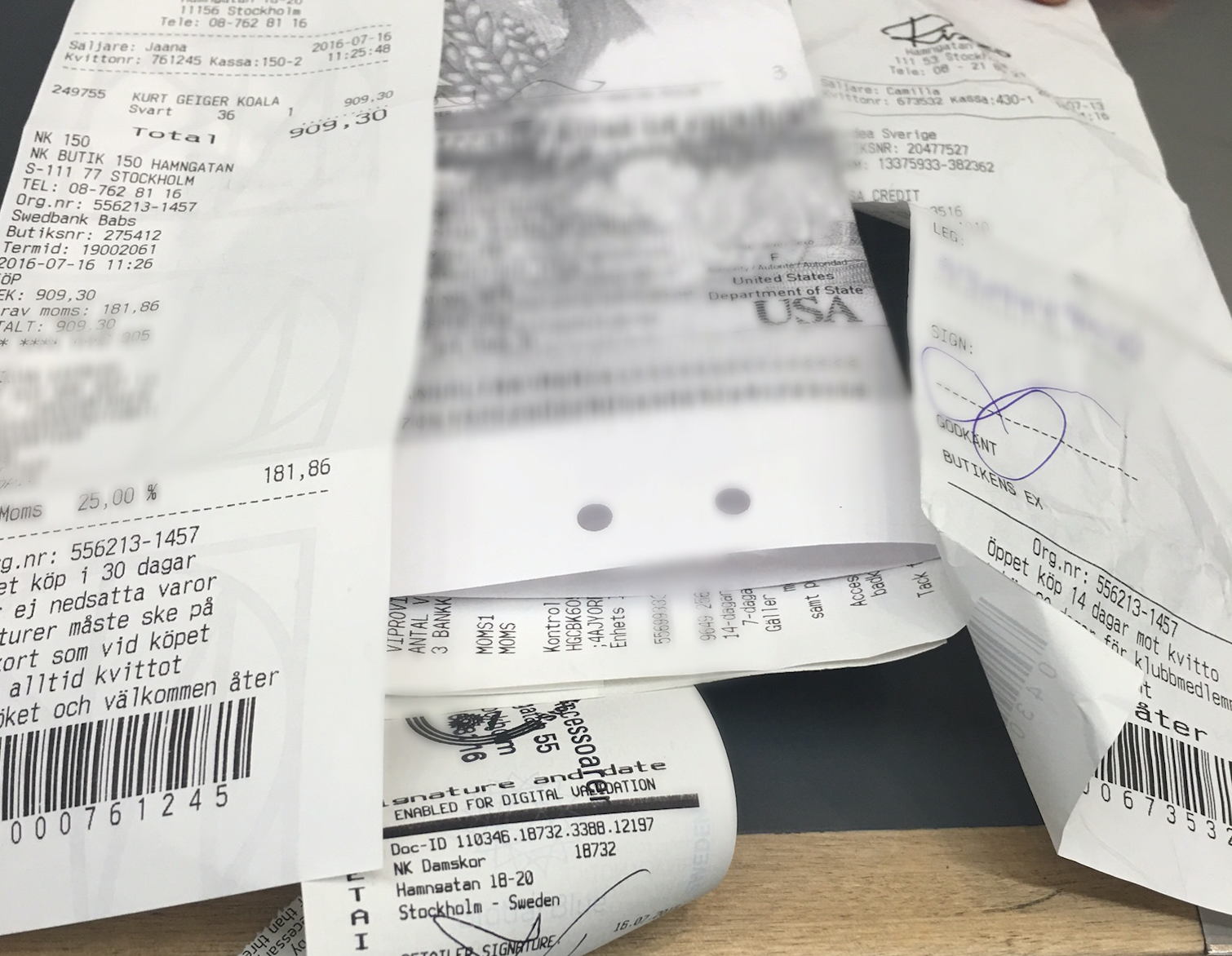

When checking out at the store, ask for the VAT refund form (aka tax-free form), and fill out the required areas. The merchant will need to see your passport, and  you will get a copy of the form stamped and stapled to your original receipt. If you go to multiple merchants, you will need follow this procedure for every transaction.

When you get ready to leave Europe, arrive at the airport/port/terminal a little early and take your purchased items (sometimes they want to see them to ensure ‘no goods are left behind’), the form(s), and your passport to the tax refund area before clearing customs. To my surprise, my refunds were lumped into one and applied directly onto my credit card.

Bottom Line

I got 312 SEK (~$36.50) back for buying some shoes and sweaters that were already on sale. It was such a seamless process that only took minutes of my time, so I like to think of it as “free money”.

You can find more details about VAT refunds here.

Feel free to share your experiences too!

re: NY vs NJ, I thought our taxes were higher than Jerz (I thought no sales tax). Does that only apply to clothing in earnest? What about shoes?

Hi heather to my understanding since I am a NJ resident, taxes apply to handbags but if I shipped it out of state, it does not. So I ended up shipping to my relatives in NY to save $$ :)

Just because you got your VAT refunded or shipped an item out of state to a lower-tax jurisdiction doesn’t mean you’ve avoided the obligation to pay taxes on purchased items.

You are obligated to pay NJ Use Tax on items that you bring back to NJ that you did not pay sales tax on or paid at a rate less than the NJ rate of 7% (whether the items were bought in NY or out of the country in Sweden). You can read more here for New Jersey but this also applies to many other US states: http://www.state.nj.us/treasury/taxation/pdf/pubs/sales/anj7.pdf

There’s very little chance of getting caught but it’s still tax evasion!

Interesting. Thank you for bringing this to light!

Back to this. Ok I get it. So Jersey has tax on bags, but not on clothes or shoes. Do I have that right?

Yup!

And it is so crazy that you were able to avoid it via shipping to NY, because we definitely have tax on Chanels :(

I think nowadays it’s always directed back to your credit card. Back 10 years ago, when I did my first VAT refund, they always had the option of giving the refund back to you in the form of cash or through a refund back to your credit card. I always opted for cash since I was always afraid there’s a tiny chance that VAT form may go missing or what not after I hand it to the officer (plus who knows how long it will take to process?!?) At least with cash, you have it on hand already!

I requested a VAT refund at CDG in Feb. 2014 for a LV purse I purchased for my mother. Instead of getting cash, I opted for it to get back to my credit card. I NEVER received the refund. My mother was on the trip with me and requested a VAT refund for several items she purchased. I don’t think she got anything back on her credit card either.

The same thing happened to me . They processed it in Milan and credited my American Express Card and never received the refund. I am calling the Vat tax central office in Milan tomorrow to see if they can trace it