The internet is on fire with the launch of a new top-tier signature credit card from Chase that has an a lucrative sign up bonus and $450 annual fee - the Chase Sapphire Reserve, which has quickly taken the title of hottest credit card out there at the moment.

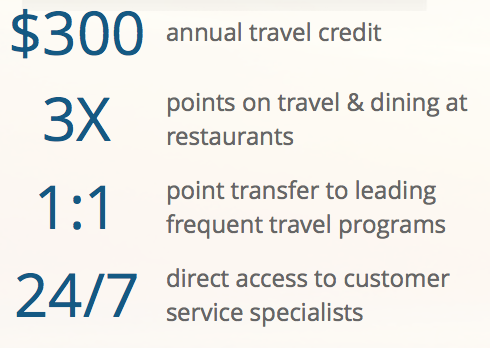

The card’s key features are an incredible sign up bonus of 100,000 Ultimate Rewards points, $300 annual travel credit (which helps against the annual fee), and 3x on travel and dining.

Many people are jumping for joy with an approval. I, on the other hand, have not had much luck, and I got a big fat rejection letter despite my excellent relationship with Chase and many efforts to try to get approved. Perhaps your luck is better than mine!

Here’s a closer look at the card’s key features:

Receive 100,000 bonus points if you use your card for $4,000 in purchases in the first 3 months.

100,000 Ultimate Rewards points are insanely valuable! There are 7 airline transfer partners (British Airways, Air France/KLM, Korean Air, Singapore Airlines, Southwest, United, Virgin Atlantic) and 4 hotel transfer partners (Marriott, Ritz Carlton, Hyatt, and IHG).

Just to put into perspective how amazing this bonus is, you can book about 11 short-haul domestic flights on American Airlines using British Airways Avios (or a boatload of Southwest flights) using the bonus points alone.

My personal favorite redemption would be a first class flight on Singapore Airlines A380 Suites (just 57,375Â points from JFK-FRA when transferred to Singapore Airlines KrisFlyer program), or Lufthansa First Class from Europe to Middle East with Singapore KrisFlyer Miles (for example, Stockholm to Dubai is just 35,000 points with low fuel surcharges), or up to 4 nights at a top-tier Hyatt property such as the Park Hyatt Milan, Park Hyatt Maldives, or Andaz Maui at Wailea.

Annual $300 statement credit for travel category purchases in the travel category for purchases that are made by the cardholder or authorized users.Â

Receive $300 back in travel purchases per calendar year! (=$600 total if get the credit in 2016 and in 2017 before the annual fee hits again).

Points are worth 50% more if redeemed for travel via Ultimate Rewards

While I personally prefer to redeem my Ultimate Rewards points by transferring to travel partners, you can get a minimum of $1,500 value if you book travel (cheap flights, fare sales, etc.) directly with Chase.

Other perks included with the card include:

- 3 points per dollar on travel and dining purchases

- Complimentary Priority Pass Select Membership – this gives you access to Priority Pass lounges in participating airports. This includes 900+ lounges in airports around the world.

- Silver Car & Avis and National Car Rental Discounts

- Global Entry or TSA Pre-Check Application Fee Statement Credit – this fee will be applied 24 hours after the fee has applied to your credit card statement. There is only one of these ($100 or $85) statement credits allowed every four years.

- Luxury Hotel and Resort Collection benefits

- No foreign transaction fees.

This card has an annual fee of $450, but the value you get immediately using all the perks of the card almost immediately off-set the fee.

What are your thoughts about this new credit card? How will you use your points?

What is the best method to know how far the Ultimate Rewards miles go especially with flights?