I’ll admit that I don’t have text message-notifications enabled for any activity pertaining to my credit card accounts. Since I pretty much operate in a cash-less household, IÂ don’t need to drain my phone battery any faster than it already does.

On the other hand, we do funny things when free points are on the table…

A few months ago, I blogged about a new way you can use your La Quinta Returns points:Â towards certain purchases made at coffee shops, restaurants, grocery stores, etc. by signing up for “Redeem Away” and linking your credit card. At the time, I did link my credit card to receive 1,500 La Quinta Returns points as a bonus for doing so, but I haven’t actually redeemed any of those points towards qualifying purchases.

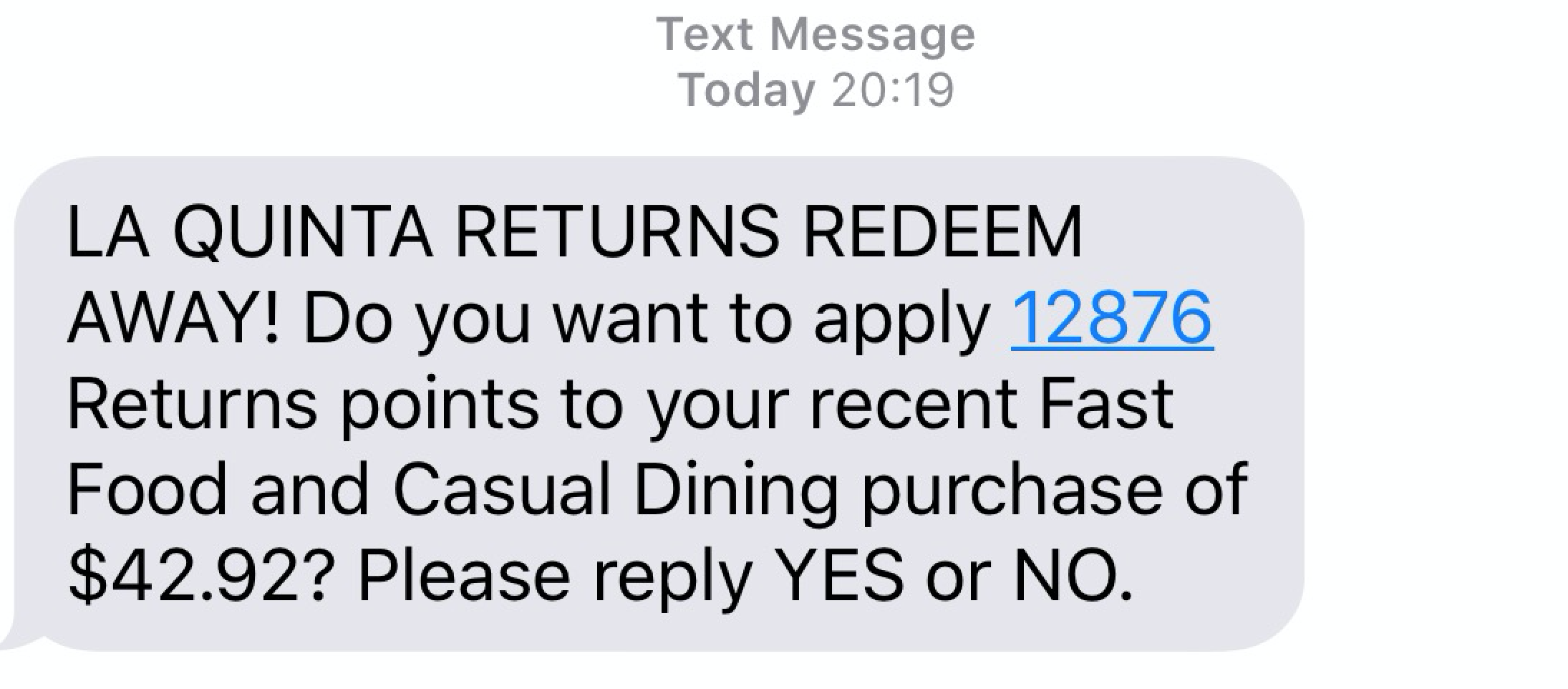

Like a science, every time I use my card at a qualifying retailer, within seconds of swiping the card, I get a text message asking me if I would like to redeem some of my points towards my purchase. While those messages are generally annoying, the one I received a few minutes ago while I was relaxing in bed saved the day:

As I mentioned above, I’m in bed; and I definitely did not order takeout, so of course this message was super alarming. I immediately signed on to my Chase account on my phone and saw a pending charge for $42.92 at a Wawa (Jersey thing) location over an hour away from me. This was not good, and only meant one thing: somebody has my card in their possession.

Luckily, I received the text message notification the instant the charge was made and that was the only fraudulent charge that went through. I can only imagine the criminals feeling victorious that a “minor” charge was successful, further fueling them to go on a major shopping spree on my dime.

While it stinks that my card is missing, Chase took care of the situation immediately and deactivated the card before any further damage was done.

Now the fun part is trying to trace back how I misplaced my card in the first place… the joys of having 16 credit cards!

Have you ever had a lost or stolen credit card? How long did it take you to find out there were fraudulent charges?

I have not lost a card but had fraudulent charges placed on it while the card was in my possession on the West Coast. I was on the East Coast. Apparently thieves will try all sorts of numbers. I has been checking my account and saw all these charges and called Chase, and gave them the number where I was vacationing. A few minutes later the Orange County, CA stolen car task force called me. They had found a crude looking card with my numbers on it in a stolen car. They kept me informed of the case including the possibility of me flying out to OC to testify. Unfortunately they did not need me but I had to write a victim impact statement.

Wow! That sounds like a crazy CC theft story. I hear all sorts of similar stuff like that too. And even stories where your cc info can be swiped at gas stations etc and then reproduced on other cards. I check my accounts religiously. Glad it worked out for you!

The criminals weren’t shopping on your dime, it was Chase’s loss because you reported the fraud promptly.

A good reason to set up free text alerts for all your credit cards.

Do you think the bank eats the loss? Naive. The merchant where the fraud happened gets charged.

And then the merchant passes their loss on to their customers…

I haven’t had a card lost or stolen thankfully (knock on wood), but somebody stole my CSP card number or something a few months ago because they started making fraudulent purchases at a few stores in the suburbs of the city I live in. Somehow Chase picked up on the fraud after the 5th or 6th transaction and marked all transactions fraudulent, deactivated the card, and called me. In all the people tried to charge $690 and some cents to the card.

I’m glad that Chase picked up on this since the charges could have very well been legitimate considering they were made so close to where I live. Maybe they could tell that the chip wasn’t right or something.

It has only happened to me once when I was in Cabo San Lucas on vacation. I even know when it happened as the card was only out of my sight once the entire trip. Turns out the restaurant we had dinner at apparently also made “copies” on the info on your card and sent it to their friends back in Texas who made a new card for themselves. They then used it on a road trip driving east on I-10 thru Texas at various gas stations, restaurants, and department stores. We lived on the east coast at the time so I did not find out about it until about 4 days later when we landed back in the US and I checked my voicemail where Amex wanted me to call their fraud department. It was already late at night so I didn’t do anything until the next morning. First I checked online to see the shopping spree and then I called Amex. I rattled off all the fraudulent charges and explained I was in Cabo at the time. They said no problem and took care of all of it. Even overnighted a new card to me. All in all it was close to $3500 in fraudulent charges, but Amex made it all go away.

Now I have emails turned on for certain charges such as card not present or above a certain limit. Too bad I didn’t have that then as I could have caught it earlier.

We had a similar experience. Someone got our username and password to our Best Buy online account and bought some stuff with our credit card on file. Fortunately I had email notifications turned on, so when I got an email telling us our order was being shipped we knew we had fraud. Called Best Buy to try to cancel the order, chase to cancel the card and the police to hopefully prosecute the thief.

Good Day Angelina

Yes yes yes

I have not actually lost or had stolen credit card but I had my bank ATM debit card skimmed in Brazil.

I became aware of the charges in about three days when I received the account statement via email.

Fraudulent charges, yes the criminals were helping themselves to $2600 of my dollars (not the banks dollars).

The first charge was about $600, from an ATM in another town in Brazil where I had never been.

The next two transactions were for $1000 each in Florida USA ( I have not been there either).

The Bank stopped the ATM card and just to be sure I diverted all remaining funds to another account.

Much paperwork and eight weeks later I had my $2600 back.

Now I have all the alerts I can on all my credit cards and debit cards.

It was an experience I could have done without.

Cheers

Chris Kirwin

Australia

I don’t carry more than 2 of my many cards with me at one time and I haven’t lost one yet, but I have had fraudulent charges put on my cards a couple of times. I have a habit of checking my card accounts online every morning – it’s only because of this habit that I’ve caught the fraudulent charges quickly while still in their “pending” status. Having had this happen twice just validates my 5 minute “habit” is worthy.

I haven’t lost or had a card stolen yet, but I have had my card number used w/o my authorization. Funny how you mention Wawa because I live in Hawaii and I had a charge for that restaurant too, but I caught it in time so that it would be declined. Whenever I get the chance to travel to the east coast I am going to have to try out a Wawa.

Have had several credit cards “cloned” by thieves. Usually, someone skims the card in a restaurant, where your card often disappears when you pay. But there is no way to know.

My card companies, particularly Chase, Amex and Discover, have very sophisticated fraud detection algorithms in their systems. If something appears amiss, I will get a phone call and a text message from their fraud prevention departments, asking if I had made a particular charge or two. If I did not, the card is killed and a new card overnighted to me. I’ve never lost a dollar to fraud, and I appreciate the vigilance of my card issuers.

There are a few lessons I’ve learned — 1) Don’t use debit cards for purchases. Use credit cards. Your liability for purchases on a credit card is limited by Federal law to $50, and I don’t know of any major card issuer that ever holds the card holder to that. And, you have 60 days to dispute a charge. You also have rights if the product you buy doesn’t work. But Federal law limits your liability on a debit card to $500, and some banks give card holders a hard time if they do not report the fraud within 30 days. And your rights to dispute a charge on a debit card are much more limited.

2) Enable fraud warning to your cell phone from your issuers for every card you have. You want to move quickly in the event of fraud. And, often your card issuer will decline a suspicious transaction. You can quickly call your card issuer to resolve the problem if you know.

U DO NOT NEED TO HAVE A LOST CARD TO GET SOMEONE USING IT!! bEFORE WE GOT NEW CHIP CARDS WE GOT A CALL THEY WERE BEING USED!!!NEVER GO THE CARDS SOMEONE ELSE I GUESS DID OR GOT THE NUMBERS CRAZY

I use apps like Trim and Penny to notify me of activity on my accounts. I get a lot of text messages from my credit cards, but I’m able to stop fraud immediately before the criminals can hit the jackpot.