As you may have noticed from my social media accounts, Barclays and Frontier Airlines invited and hosted a handful of bloggers and their entire families to their headquarters Denver earlier this month to unveil some family-friendly refreshes they had in the pipeline.

You might recognize some familiar faces in the photo above, and it’s safe to say we had a blast and made memories of a lifetime together on that trip. I have a separate post about our experience in Denver on the way a bit later today!

Fun, family, and friendship aside, I’ve been sitting on some exciting news for a few weeks, and now is the time I can finally share it!

But first… a bit about ultra low cost carriers

While we all certainly love our upgrades, it’s hard to ignore ultra low cost carriers at family-friendly price points when you can snag a seat in the sky from point A to B for less than a full tank of gas.

European and Asian travelers seem to embrace the low-cost carrier way of flying just fine, and the low-fare, no-frills system really seems to run smoothly in those parts of the world. I’ve taken my fair share of RyanAir and AirAsia flights during my family travels, and quite frankly they were absolutely perfect every single time.

We recently traveled as a family of four from Singapore to Langkawi on AirAsia for just ~$33 each (and that just happened to be the most expensive day available that month – most flights were in the $14 range!). That low fare was the golden ticket for us to discover Langkawi and the brand new Ritz-Carlton that I absolutely fell in love with!

We all know that the cost of travel adds up quickly when you travel as a family, and everything costs extra when you travel on a low cost carrier airline, such as checked-bags, snacks, and even seat assignments.

Because we travel lightly and don’t care where we sit on board (I must say that airlines do a great job of keeping families with young children together on board), ultra low-cost carriers really do open up the skies for traveling families on a budget.

However, let’s not ignore the elephant in the room. In US markets, there is more of a push back and poke at ultra low-cost carrier airlines, and the market is a bit different. For instance, the typical traveler on Frontier is the infrequent traveler that travels 1-3 times a year and doesn’t really understand the mileage game.

I recently flew Frontier from Denver to New York for the first time with my family and there were no complaints. We had on-time arrival and friendly service – that’s all that really matters, right? Because there was no wifi on board, I did something that seems obsolete these days – I started chatting with my seat mate, a free-spirited artist who says she doesn’t travel often because it’s expensive. Needless to say, she was over the moon about her spontaneous $39 fare to see a friend in New York!

I think that once travelers can trust that ULCCs are reliable, working out kinks and innovating to make the experience better without increasing the cost, and are adaptable to how travelers want to feel rewarded, then people will begin to welcome them with open arms.

That’s exactly the goal Frontier had in mind with its reimagined credit card and loyalty program refresh, designed to reward everyone from first-time flyers to frequent flyers, adding value to everyday spending, and making air travel attainable for all.

Frontier Airlines World MasterCard®

Barclays and Frontier Airlines today announced the relaunch of the Frontier Airlines World MasterCard®, which allows cardmembers the opportunity to unlock Elite Status solely through card spend.

Frontier is the only U.S. airline where for every dollar spent, cardmembers receive one Qualifying Mile toward Elite Status. The refreshed card program offers even more ways to earn miles with the dynamic 5-3-1 earning structure. Cardmembers earn 5x miles on purchases at flyfrontier.com; 3x miles on restaurant purchases; and 1x miles on all other purchases.

New cardmembers earn 40,000 bonus miles (enough to redeem for up to two round-trip award tickets) after spending $500 on purchases in the first 90 days and paying the $79 annual fee. There are no foreign transaction fees, and you also receive complimentary access to your FICO® credit score.

All Frontier Airlines World Mastercard cardmembers receive benefits like priority boarding (zone 2), an award redemption fee waiver and family pooling, which allows one primary member and up to eight pool contributors to combine myFRONTIER Miles.

Plus, you can earn a $100 flight voucher after every account anniversary after spending $2,500 or more on purchases with your card during your card membership year.

The card also comes with World Mastercard® Benefits including concierge service, travel accident insurance, trip cancellation insurance, baggage delay insurance, auto rental collision damage waiver.

Unlock Status Through Spend

The new Frontier MasterCard allows you to unlock more perks the more you use the card. Frontier is one of the few airlines that still offer a “mile per mile” loyalty program, meaning a mile flown is a mile earned.

The good news is that you don’t have to even fly once to unlock elite status with Frontier if you’re unable to jet set around the 90 US cities served by the airline.

Cardmembers can unlock myFRONTIER Miles Elite Status by earning one Qualifying Mile with every dollar spent on purchases each calendar year.

- Elite20k Status: Spending $20,000 on the card each calendar year earns benefits like a free carry-on bag and seat assignment.

- Elite50k Status: Spending $50,000 on the card earns all the benefits from Elite20k Status, plus benefits such as family seating and seat assignment for the cardmember and eight travelling companions on the same reservation.

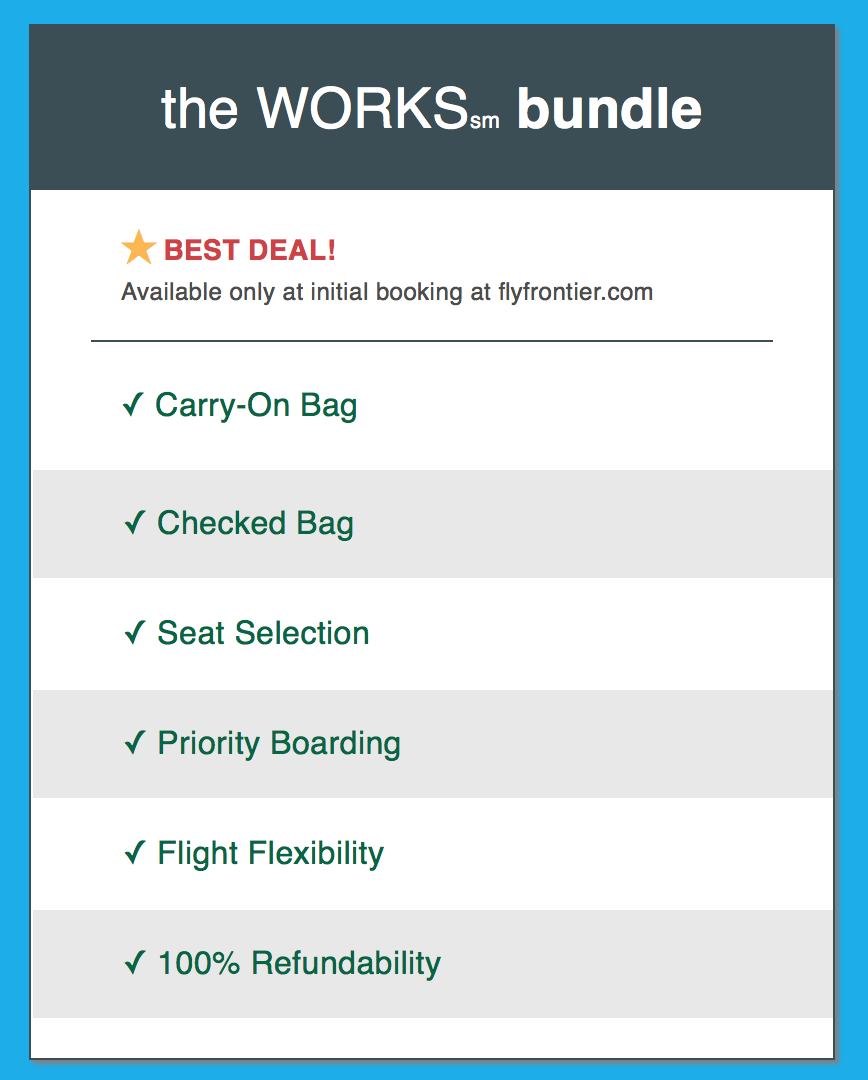

- Elite100k Status: Spending $100,000 on the card qualifies the cardmember for Elite100k Status, which provides The Works bundle (making flights 100% fully refundable) for the primary cardmember and up to eight traveling companions on the same reservation.

Spending less than $1,700 per month on the card not only earns you redeemable miles towards award flights, but can also help you and your entire family fly without any carry-on bag fees.

New Elite Levels

Not only did Frontier revamp their ‘old’ frequent flyer program, Early Returns, that had just one elite status level, with the credit card refresh, Frontier changed the name of the program to Frontier Miles, and also added two new elite tiers with distinctive benefits:

Bottom Line

Did you know that 90% of Americans live within 90 minutes of an airport served by the airline? With 5 hub cities (Denver, Las Vegas, Chicago, Trenton/Philly), and over 300 daily nonstop flights, Frontier Airlines is rapidly growing (28 new cities launching in 2018) and really encouraging people and families to spend more time in the sky.

The family pooling cardmember benefit is huge for traveling families. Family Pooling takes the whole family into account, and the elite benefits don’t just reward the most frequent traveler. I especially love JetBlue for their points-pooling option, but Frontier takes it a step further and lets cardmembers designate up to 8 people of their choosing to be contributors in their family pool.

On the redemption side, award flights will continue to be available from 10,000 miles each way. With base fares so low to begin with, the card’s key compelling benefits come from the unique ability to earn status from spend, allowing you to continue to buy the cheap seats and worry less about feeling nickeled-and-dimed with bag and seat-assignment fees when you fly as a family.

Plus, making use of the yearly $100 anniversary voucher (which can be applied to multiple tickets on the same reservation, three $39 tickets, for example) makes the card pay for itself right off the bat.

I certainly think the refreshed Frontier Airlines World MasterCard® truly is an attractive card that’ll end up on the radar of many families, and I’m so excited to be able to finally share news!

Feel free to share your thoughts below!

Something that caught my eye was when you mentioned “award redemption fee waiver”

Can you tell me how much this fee is? That’s a bit of a turn-off that they would even charge this in the first place…..I say this because I’m just shy of 10k miles in my account for a free flight and didn’t know anything about this.

Hi Steve, Frontier really does has unfriendly fees when trying to redeem miles less than 180 days before departure. Starting at $15 when redeeming miles or flights between 179 and 21 days in the future, jumps to $50 for 7-20 days, and $75 for less than seven days before departure. Pfft…