I’ve had the Citi Prestige since it was first launched in 2014, and it has been in my wallet ever since thanks to many of the card’s compelling benefits, including a $250 yearly airline credit, 4th night free on paid hotel bookings (which has easily saved my family over $1,000 per year), and arguably the best trip cancellation/interruption coverage on the market.

Personal Experiences with Citi Trip Interruption Protection

What I like about the Citi Prestige’s insurance benefits is that the process is seamless, and they are quick to reimburse. A few years ago, I had an incident where United lost and damaged my double stroller. Since I paid for a portion of the airfare with my Citi Prestige, the coverage reimbursed me $599.94 for the total cost of a new stroller. I’ve had a few instances where I had to cancel a trip, and Citi pulled through and covered the cancellation fees as well.

The Citi Prestige recently changed its trip delay protection from 3 hours to 6 hours for tickets purchased after July 29, 2018 and limited the coverage to just family members.

Just this past summer, my family took a trip to Europe. I redeemed Aeroplan miles for 4 tickets in United business class from Newark to Frankfurt with a layover in Brussels. Even though I used miles for the trip, I paid the nominal taxes and fees associated with the tickets with my Citi Prestige card.

Unfortunately, we had a huge mechanical delay on the outbound flight that resulted in us not only misconnecting, but also arriving into our final destination over 7 hours later. Our delay caused us to have a long 4-hour layover in Brussels without any of our checked bags, so I purchased necessities and snacks for the kids at the airport.

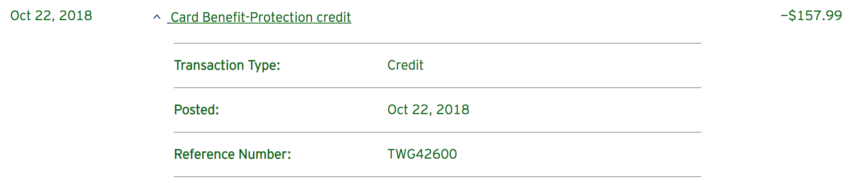

Though the benefit is very generous, allowing reimbursement up to $500 per traveler, I only spent a total of $157.99. After all, this was sort of an experiment for me, and I didn’t want to be SOL.

When I returned home from the trip, I calculated all of the charges made in Brussels during our layover and called to initiate a claim if $157.99. I had to submit over supporting documentation, including the charges as they appeared on my statement, the associated flight booking charges from my statement, and proof of the delay. Within a few days, I saw a statement credit for the full amount of my claim.

Long History of Citi Prestige Changes

Of course, while the Citi Prestige is a staple travel card for me, let’s not forget that the card has devalued plenty since first launching.

Benefits no more include: American Airlines Admirals Club access, elimination of the golf benefit, a change to how the 4th night free hotel benefit is calculated, loss of 1.6x for American Airlines airfare redemptions using ThankYou points, and many downgrades to protection.

Changes to protection include:

- Trip Delay Coverage: Protection now kicks in at a 6 hour delay and limited to just family members when it was previously 3 hours and offered protection to all traveling companions.

- Damage & Theft Purchase Protection: Coverage was previously 120-days and primary (except in New York). Now it’s 90-days and secondary, and with new exclusions.

- Price Rewind: Coverage was previously up to $500 per incident and $2,500 per year. Now it’s $200 per incident and $1,000 per year, and with all new exclusions.

- 90-Day Return Protection: Coverage was previously $500 per item and $2,500 per year. Now it’s capped at $1,500 per year, and with all new exclusions including appliances.

Even with a history of continuous devaluations, I still held on to the card because I find it worth it to continue paying the annual fee each year for the other travel benefits.

More Changes Ahead for 2019

Another round of changes is scheduled to take place beginning January 4, 2019 (and the card will finally be open for new applications again since August 2018).

The revamped Citi Prestige will offer 5x on dining and air travel, 3x on cruise lines, and a broader use of the $250 airline credit, which will cover travel purchases in general. Additionally, the card will offer cellphone protection for damage and theft in May 2019, though there aren’t comprehensive details about this benefit yet.

However, with those positive enhancements, there are certainly some devaluations to add to the list beginning in September 2019:

- The annual fee will be increasing to from $450 to $495 yearly

- The 4th night free hotel benefit will be limited to only twice per calendar year

- Goodbye to 2x on entertainment purchases as it will be replaced with a new earnings rate of 1x

- The 25% bonus for air travel redemptions made directly through the Citi travel portal will be going away.

The rest of the card’s benefits remain unchanged, including 3x on hotel purchases, Global Entry/TSA PreCheck fee credit, missed event protection, Priority Pass membership that allows 2 guests, Citi Price Rewind, and the trip cancellation/delay insurance.

What’s a Girl to Do?

Of course I hate devaluations just as much as the next person, but I’m not rushing to close my card just yet. My membership renews in February 2019, so I won’t be slapped with a $495 annual fee until February 2020. Between now and then I’ll be able to collect a total of $500 in travel credits ($250 per calendar year), a value that would exceed what I’d pay in an annual fee.

In terms of the changes and limits to the 4th night free hotel bookings, that obviously stings the most. To add salt to the wound, there’s language in the changes indicating that direct bookings can no longer be made through the Citi Prestige Concierge, which means that the 4th night free bookings would not earn points, allow you to book using specific rates, or allow elite benefits during the stay. This is an absolute deal breaker for me.

The terms specifically state:

Beginning 09/01/2019, cardmembers will be eligible for no more than two complimentary Fourth Night benefits per Card Account per calendar year.

To receive your complimentary Fourth Night, you must 1) book a minimum of a four-consecutive-night hotel stay through thankyou.com and 2) pay for your complete stay with your Citi Prestige Card, a redemption of ThankYou Points, or a combination of ThankYou Points and your Citi Prestige Card.

Booking through the Citi Prestige Concierge (only available through 08/31/19)

The optimistic side of me is grateful that I still have more than 9 months to enjoy the 4th night free benefit as it stands. I will certainly make use of it during that time, while also enjoying 5x on dining and airfare purchases, both which are positive and generous changes that go hand in hand with the regular spending I put on the card anyway.

What are your thoughts about the Citi Prestige and the changes ahead? Will you keep or cancel?

It will be a sad day, but I will definitely cancel when the new 4NF nerf goes into effect, unless I get a massive retention bonus. At 2x a year with no elite benefits, they might as well have eliminated it completely.

I didn’t have much luck with a retention bonus on this card. Curious if these changes will allow them to be more generous with that. Keep us posted!

….the golden goose is DEAD. In the immortal words of singer/songwriter Alan Jackson: “…Remember When…..” I’m

Canceling.

Here are the two factors that will impact my decision:

#1 I am still paying the $350 annual fee, so if it goes up to $495 then I will need to rethink if the card is worth paying $245/year for me.

#2 The critical key is whether or not I can book the hotels at the destinations I go to at good rates. If I can’t get the hotels I want at the same rates as booking direct then I will cancel the card. The 4th night benefit is pointless if I cannot get the hotels I want or if the rate is more expensive than booking direct.

If the card fails both #1 and #2 then I will definitely cancel the card and use the $245 for other purposes.

Totally agree! Couldn’t have said it better myself.

For the 4th night benefit to work, the cost for using the CITI Prestige has to be at least $200 cheaper than paying for 4 nights booking direct.

While getting 5X for airfare and restaurants is great, without the 4th night benefit this card is definitely not worth it.

Even with the current terms, getting the CITI Concierge to book the lowest rates online is not always the cheapest. Last year I was able to email a boutique hotel in Bali and got 4 nights from them cheaper than what the CITI Concierge was able to get me with the 4th night credit at the lowest online rate.

I have had some success emailing hotels directly and getting rates that are lower than the lowest rates the hotels post online.

My annual fee is due Aug 2019, at which time I will cancel the card. Not being able to book the 4th night over the phone is the deal breaker for me. I miss the days of AA lounge access and golf, I will be switching over to AMEX plat

Yup! I feel exactly the same. Too many cut backs

How do you go about obtaining “proper proof” from the airline regarding why they had the delay? I’ve struggled with that in the past.

Hey Antonio, what I provided was flightradar data confirming the delay and a screenshot of my United flight status at the time. That worked like a charm!

The limited hotel selection and not-the-best price point via online booking is 100% deal breaker for the fourth night free benefit, which ironically was the original reason I signed up for the Prestige. Price rewind is saving me $$$, but I’m pretty sure I can do that via Premier.

You mention the two airfare reimbursements you get from renewing your card; but the first of those you can get before renewing. Only the second one (to take place in January 2020) depends on renewing the card. Does that change your calculation? It did for me (I also got the card when it first came out). When I got the card, much of the value I expected from it were Priority Pass, the 1.6 cent value of ThankYou points for purchasing AA tickets, and the AA lounge access. 4th Night Free and Citi Price Rewind were secondary.

Now the AA lounge access is gone, the Priority Pass lounge access no longer works at Alaska lounges, and 4th Night Free is apparently for scamming an employer or other reimburser, as the price of the rooms is marked up by 30% or more over what is available by direct booking.

My calculations include 2 $250 travel credits before my $495 is due in February 2020. If no other improvements are made by that period, I plan on cancelling the card In February 2020. It’s a shame that they are constantly changing the benefits on us

Strange the prestige only covers a 6 hour delay on one segment missed connections are not covered no?

My flights were booked prior to July 29th and we had a 4 hour mechanical delay on the first segment

Too many awesome cards to keep this one after Sept. unfortunately. If they switched back to concierge by phone for the two night limit I could happily keep the card and break even/make a little back. Otherwise losing 8 nights worth of points and elite credits kills it. It’s really sad, I use the 4th night credit weekly right now. I think CSR and Amex Plat both beat the revamped Prestige

It always works like that: at first, they get you on the hook by offering generous perks, but gradually cut them back until it becomes pointless. I still have time till Aug 2019 to squeeze all out of my card, and then I’m cancelling.

Three times I tried to book my hotel through Connexions and couldn’t. Without the fourth night benefit, losing the 20% off perk is a deal breaker for me. I wonder how long the Premier card will maintain the 20% discount? I am using up my points since I see the writing on the wall. The rewind feature is the only good perk left, but I can get it from my other Citi cards.

Hi do you know if the prestige trip delay only kicks in for round trip purchases or can it be used on one way purchases? Likewise same question for the ritz carlton card and other cards with trip delay?

Thanks!

Another subtle devaluation that has not been covered anywhere is that the Trip Cancellation is insurance is $5,000 per TRIP not per person per trip. That is direct from the CITI Benefits rep and states the change went into effect July 2018.