I just topped off my 401K contribution as 2018 comes to an end. Saving for the future is important for my family, and chances are if you’re in the miles and points hobby, you’re also pretty disciplined with your money and in good financial health.

After all, it takes a certain type of person to truly understand the value of earning and redeeming rewards. While earning miles, points, and cash back on purchases can be a lucrative return providing an almost instant gratification (so much “book now, think later” and FOMO thrown out at us), there’s another rewards program that’s worth bringing attention to that’s designed to help families create and maintain a college-savings strategy – Upromise.

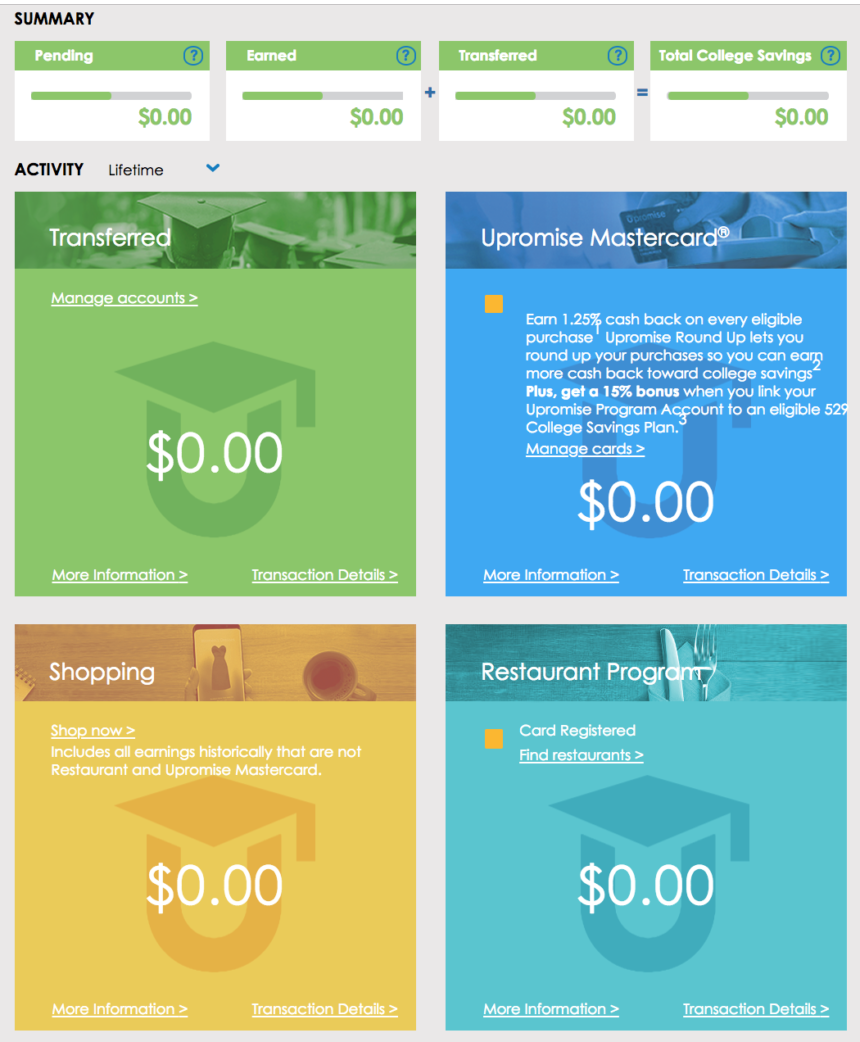

Upromise is a free gateway that helps fund any 529-college savings plan by offering rewards through its shopping portal, dining program, and through co-branded credit card spend. In the past 18 years, Upromise has helped families save over 1 billion dollars.

I recently learned about and created an account at Upromise to learn more about how families can earn rewards. Saving for college or higher education can sometimes end up on the back burner because often families have other immediate financial priorities and pressure. Upromise helps automate those savings by allowing families save a little bit every day through normal everyday spending.

I opened up free 529-college savings accounts for my children when they were just a few months old. You can do some research and see what plan or investment strategy might make sense for your family, but as you might already know, you can use a 529-college savings account not only just to pay for a college education, but also at trade schools, the purchase of text books, and private K-12 education as of this year, so it’s certainly a financially-savvy move for families to consider.

The cool part about Upromise is that anyone can join. If there’s a grandparent or relative that may not “get” the miles and points hobby but still wants to contribute towards your family’s future in small ways, they can create a Upromise account or apply for the Upromise® Mastercard® and use those rewards to fund your child’s 529 college savings plan.

Upromise Shopping Portal

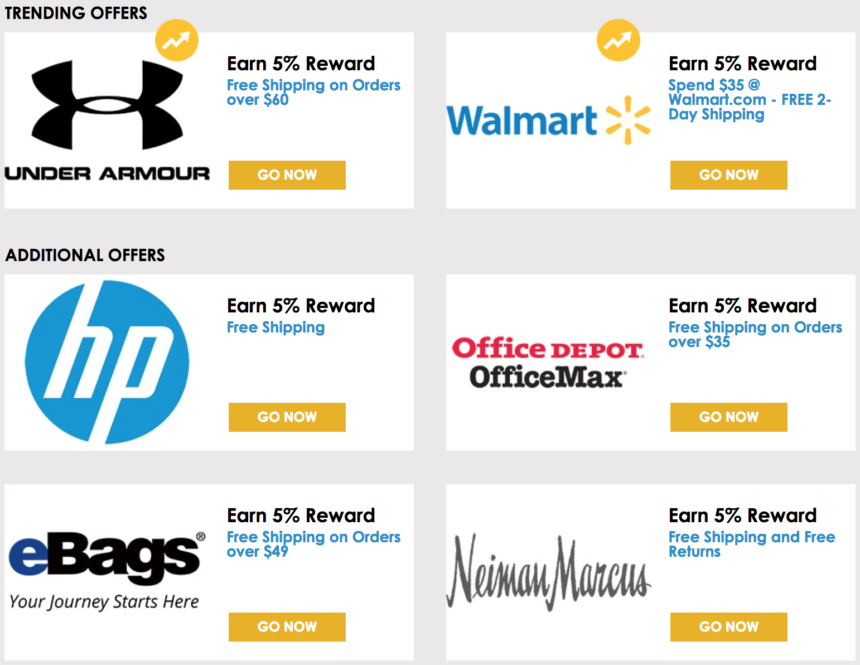

It’s always smart to earn rewards when shopping online, and I always recommend comparing portals that offer you the best return.

As an example, Upromise is offering 10% back (in the form of college savings) on purchases made at Under Amour until January 1, 2019. Comparing portals using CashBackMonitor.com, you can see that Upromise currently offers the highest rebate for the retailer.

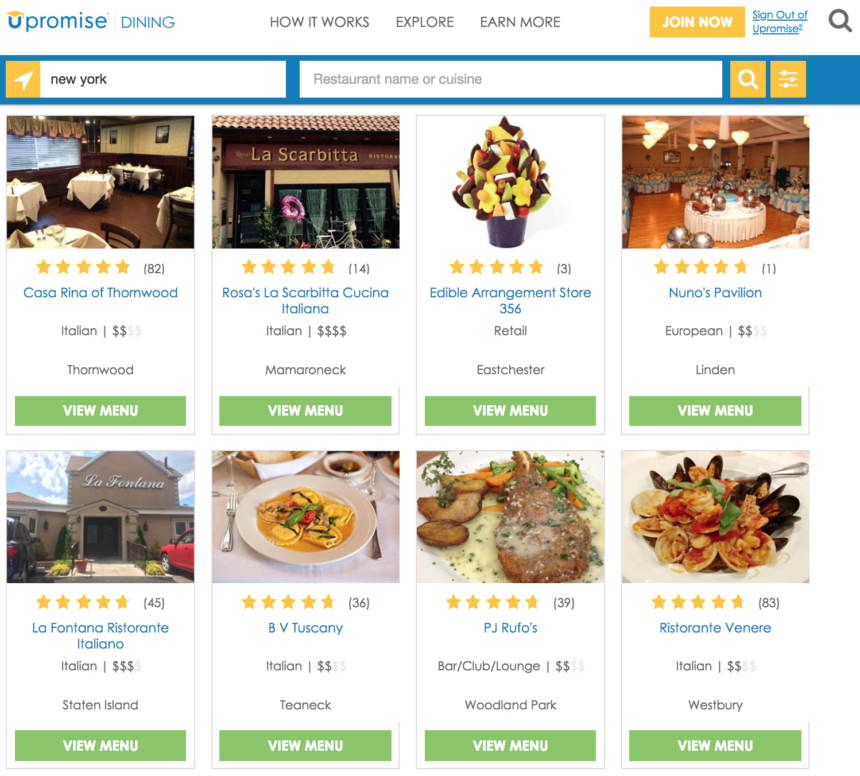

Upromise Dining Program

The Upromise dining program allows you to earn 2.5% cash back on your entire meal, including drinks, tax, and tip when you link any credit card at dine at hundreds of nearby participating restaurants.

The 2.5% you can earn is in addition to what you would earn with your credit card rewards, so you can link your new American Express Gold Card for 4x on dining purchases or your Chase Sapphire Reserve for 3x on dining purchases to maximize your return.

Upromise® Mastercard®

Barclays recently refreshed its Upromise® Mastercard®, making it a simple product (no annual fee). Sure there are plenty of no-annual fee cards that may offer more than 1.25 cents back on everyday purchases such as the Chase Freedom Unlimited (1.5x) and The Blue Business℠Plus Credit Card from American Express (2x on up to $50,000 spend annually), but the card also comes with some unique features such as a 15% bonus on all cash back earned when you link an eligible 529 college-savings plan and the ability to opt-in to round up purchases (set and funded by you).

Additional card benefits also include no foreign transaction fees (which is a rare find for most no-annual fee cards), access to your FICO score, and a free ShopRunner membership.

You can redeem your rewards by either directly connecting your Upromise account to any eligible 529 savings plan and allowing the awards to redeem automatically once you reach a $50 balance, or you can elect to link a checking or savings account and then make your deposits into the 529 plan manually.

Bottom Line

Kids really do grow up so fast. In fact – it’s bittersweet that it’s already time for me to renew my son’s passport. As I once quoted in an article about the importance of still traveling after having kids, you only have 18 summers with your children, so make them count. Not only does that apply to making memories, but also preparing for the future.

While I personally love earning miles and points to use towards family travel, learning ways to balance life in the present moment and plan for the future creates a healthy and happy family balance. While the Upromise® Mastercard® may not be the best fit for everyone, it’s an easy way for some families to get in the habit of saving for inevitable educational expenses in small doses.

Have you ever used Upromise before?

Best strategy for financing college is to encourage your child to do well in school, take the most challenging coursework in high school. and apply to colleges that offer merit scholarships. Both of my kids had at least 50% of their fees covered by merit scholarships – this equaled a value that I would not have been able to save on my own.

Jane, I absolutely agree with your philosophy and couldn’t have said it better myself. Thanks for stopping by and I hope you have a happy and healthy new year

I have been using Upromise since 2003. It’s been an amazing savings tool. My kids are only 6 and 3, but I opened up “their” first 529 account when I was only 18 in college. Until 2 years ago I was never into the rewards points travel game and only into cash back, so Upromise was my go to for many years. For those that just want a simple way to earn cash back and know it’s going to a great cause, I’d highly recommend it. Takes far less time than all the rewards searching we do.