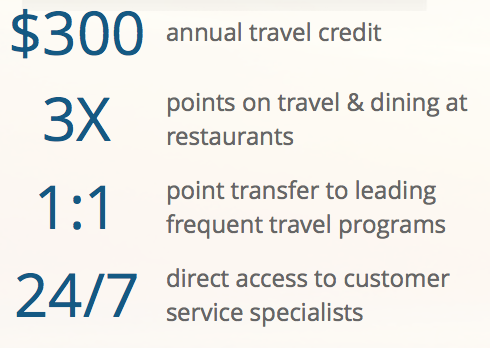

The internet is on fire with the launch of a new top-tier signature credit card from Chase that has an a lucrative sign up bonus and $450 annual fee - the Chase Sapphire Reserve. The card’s key features are an incredible sign up bonus of 100,000 Ultimate Rewards points, $300 annual travel credit (which helps against the annual fee), and 3x on travel and dining. I already knew it would be a challenge for me and others to get approved for this card because of the Chase 5/24 rule, but I defied the odds of 5/24 when I recently got the Freedom Unlimited card, so I was feeling hopeful.

I already knew it would be a challenge for me and others to get approved for this card because of the Chase 5/24 rule, but I defied the odds of 5/24 when I recently got the Freedom Unlimited card, so I was feeling hopeful.

I applied for the card this morning and got a pending review. I called the Chase reconsideration line at 888-245-0625 (long wait times – I wonder why) to get a decision about my application right away.

After the specialist evaluated my application, he told me I was denied for opening too many accounts and that there was no option for reconsideration. My only option would be to do a product swap, but then I would not be eligible for the sign-up bonus (no thanks).

I live-tweeted my disappointment, and others encouraged me to visit a branch to see if the application could be personally pushed through by a banker. As a Chase business and personal banking customer in good standing with excellent credit, I felt confident.

The banker called a senior credit specialist to review my application, and I was unfortunately still denied… but… I learned that I was invited to join Chase Private Client, and I would be approved if I upgraded my accounts.

I don’t know much about CPC, and I wasn’t ready to make a decision on the spot, but for now, it is seeming like they’re making it really hard… and possibly really expensive for me to get an approval.

What are your thoughts? What has your experience been with the CSR or CPC?

I got denied also, apparently too many cards opened in 24 months.

After I submitted the application, I got the “pending decision” screen so I called the reconsideration line and was told the same thing. Too many cards opened in 24 months. I think I am at 6/24.

Any salary requirements? Any minimum credit history needed?

Actually I think the comments on Twitter were suggesting you go in branch and ask if you were pre-approved and if you were, apply again. Try that before being disappointed.

Stopped by the local branch in Monday. The banker said I had been “pre-approved” and the card is coming tomorrow.

I applied as well and They said the same thing. As long as one is in good standing and has a strong deposit relationship, and good credit — they should not get denied.

Well beyond 5/24, credit less than 700 (as of recently for a snafu on an account I’m an AU on). Went in branch and found out I was pre-approved, applied and approved with 28k. Shocked but ecstatic.

Unfortunately for some of us, no Chase branches anywhere in the state or within 300 miles. Looks like they didn’t want many of us so I’m moving on. I’m right around 12/24 and wasn’t sitting by computer when it leaked last week.

What do you have to lose for switching account to Chase Private Client? Other than keeping certain minimum levels of balances on hand (deposit and investment), I don’t think there are any other fees you need to worry about.

I just got off the phone (using the reconsideration line mentioned in the post) with Chase, and the customer service agent said he would recommend me for a $34,000 line of credit for the Sapphire Reserve card. I was at exactly 5/24 when I applied online a couple of days ago.

I didn’t have a reference number to give him, so he had to take my full social and date of birth, which I was internally hesitant to do (but which I did, given how prevalently the reconsideration number has been posted all over the internet… so we’ll see if I get fucked over in the coming months). He asked for my income, income source, housing (own or rent) status, and how much I pay per month on rent. I gave him the same answers I used on my online application. He said the final decision would be made by the senior managers, but I’ll remain optimistic.

I told him I had opened a Chase Ink Plus account a few months ago and that it was an awesome card, and he took note of that (I don’t know if he actually did anything with it, but the way he said it made me think it might be a factor).